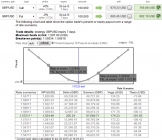

Put call parity of GBP/USD straddles

Jun 26, 2015 13:10 pm UTC| Insights & Views

The portfolio contains an ATM call and ATM put of the same maturity of same underlying currency then they must have the same present value.Else, arbitrager can add longs on the undervalued portfolio and short on overvalued...

Italian economy restarts, FTSE MIB remains cheap to buy

Jun 26, 2015 13:08 pm UTC| Insights & Views

After long struggle, European Central Banks (ECB) asset purchase program of 60 billion per month along with crucial reform pursued by Italian government seem to have restarted the Italian economy. After Markit economics...

USD/CAD binary calls luring returns; prefer ITM calls over ATM calls for hedging

Jun 26, 2015 12:27 pm UTC| Insights & Views

USD/CAD has been bouncing to evidence strength, it has breached 1.2350 levels and most likely to prop up 1.2395 levels.Currently the pair is trading at around 1.2355 levels, the pair is all boosted to hit 1.2400...

No ELA calls in spite of crucial weekend

Jun 26, 2015 12:08 pm UTC| Insights & Views

According to European Central Bank (ECB) officials as of now, there has been no calls for Emergency Liquidity Assistance (ELA) from Bank of Greece. Today stands as third consecutive days, when there has been no call for...

FxWirePro: Capitalize EUR/JPY’s slumps through diagonal bear spreads

Jun 26, 2015 11:38 am UTC| Insights & Views

As ongoing Greeces debt defaults mounting Grexit pressures, the below strategy on hedging grounds is most suitable at prevailing Euro zone conditions, the pair is likely to sense little bearish downside risks as long...

What are latest offerings from Greek lenders?

Jun 26, 2015 11:31 am UTC| Insights & Views

Below are the key aspects of latest offerings from European creditors to Greek government. Greek government need to take up reforms to ensure budget surplus of 1% in 2015, 2% in 2016, 3% in 2017 and 3.5% in...

Oscillators signals weakness in Aussie dollar; deploy binary puts & bear spreads

Jun 26, 2015 11:02 am UTC| Insights & Views

On daily charts of AUD/USD, RSI (14) evidences a falling price convergence at 43.8394; downward momentum has been observed from last a week or so.Hanging man pattern candlestick occurred two days ago followed by long real...

- Market Data