The portfolio contains an ATM call and ATM put of the same maturity of same underlying currency then they must have the same present value.

Else, arbitrager can add longs on the undervalued portfolio and short on overvalued portfolio to make a risk free profit on expiration day.

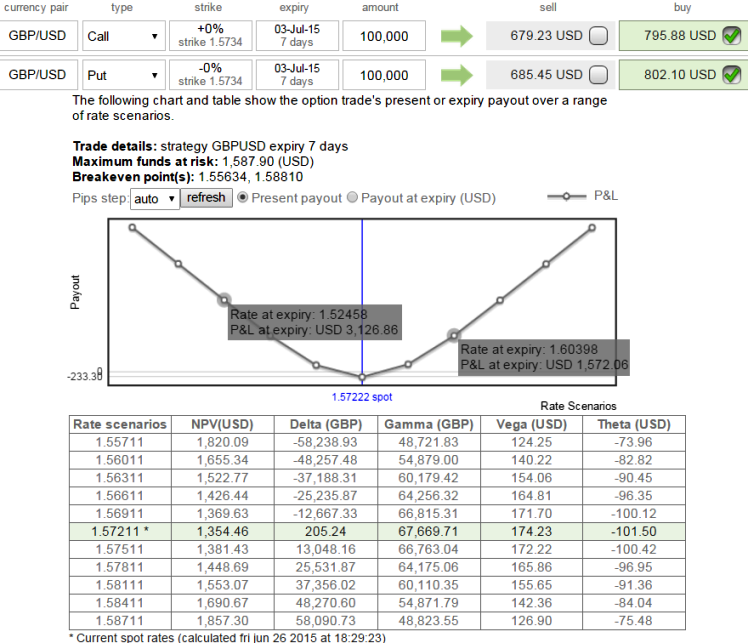

Hence, taking the need to calculate the present value of the cash component into account using a suitable risk-free interest rate, we have computed and illustrated the Put call parity of GBP/USD straddle:

We considered At-The-Money options while calculating Put call parity of GBP straddle structure as shown in the figure.

C = S + p - Xe-r (T- t)

= 1.5725 + 802.06 - Euler (1.5725*2.71828) - 0.02*(7)

= 799.218

P = c - S + Xe-r (T- t)

= 795.86 - 1.5725 + Euler (1.5725*2.71828) - 0.02*(7)

= 798.422

Where,

S = Current Exchange Rate at around 1.5725

X = Exercise price (strike) of option = 1.5725

C = Call Value = 795.86

P = Put price = 802.06

e = Euler's constant - approximately 2.71828 (exponential function on a financial calculator)

r = continuously compounded risk free interest rate is deemed as 2%

T-t = term to expiration measured in years = 7 days

T = Expiration date

t = Current value date

Inference: Before jumping into a conclusion of above calculations, one has to be mindful of how the supply and demand impacts option prices and how all option values (at all the available strikes and expirations) on the same underlying exchange rates are related.

Put call parity of GBP/USD straddles

Friday, June 26, 2015 1:10 PM UTC

Editor's Picks

- Market Data

Most Popular

9

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?