FxWirePro: Flirt Yellow metal prices with 3-way straddles versus put eyeing on IV skews

Jul 15, 2016 13:20 pm UTC| Insights & Views

On the Comex division of the NYME,goldfor August delivery edged forward 0.06% to $1,333.50 a troy ounce. Markets had dismissed the possibility of policy tightening this year with odds at 100% that the Fed will keep...

Jul 15, 2016 12:47 pm UTC| Insights & Views

Fitch will review its Poland rating today. We expect the rating (A-) and outlook (stable) to be left unchanged. There is a small risk that the outlook will be lowered to negative, in line with what other agencies have for...

Jul 15, 2016 12:33 pm UTC| Research & Analysis Insights & Views

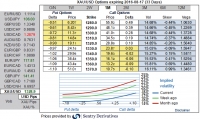

The above diagram demonstrates the equal probabilities of gamma effects when you move towards on either direction of OTM or ITM strikes. These gamma values measure the rate of change of the delta with respect to the...

China's H1 2016 monetary data reveals growing divergence between M1 and M2 growth

Jul 15, 2016 10:59 am UTC| Insights & Views Economy Commentary

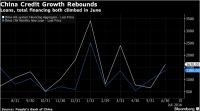

Chinas H1 2016 monetary data released by the Peoples Bank of China (PBoC) showed that New Yuan Loan rebounded to RMB1.38trn from RMB985bn in June, much higher than market expectation (RMB1trn), resulting in a total RMB...

Jul 15, 2016 09:45 am UTC| Research & Analysis Insights & Views

The Chinese economy grew 6.7% YoY in Q2 2016, unchanged from Q1, to bolster the growth in order to achieve 6.5-7.0% growth target, further monetary policy easing is still on the table. The slowdown in M2 growth in recent...

FxWirePro: USD/CNH 1y volatility structurally expensive, Shorting Vega has good risk-reward

Jul 15, 2016 08:52 am UTC| Research & Analysis Insights & Views

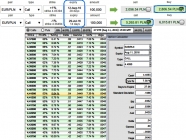

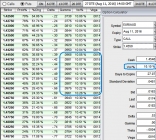

Shorting vega and downside has good risk-reward Vega volatility structurally expensive. USD/CNH 1y implied volatility consistently trades at a significant premium above the realised volatility (see above graph). The...

Jul 15, 2016 07:27 am UTC| Research & Analysis Insights & Views

1m ATM IVs are trending more than 11% which is favourable for option holders. As you can glance through the skewness in 1m IVs of AUDUSD, they highlight more probabilities of underlying spot sensitiveness to the OTM...

- Market Data