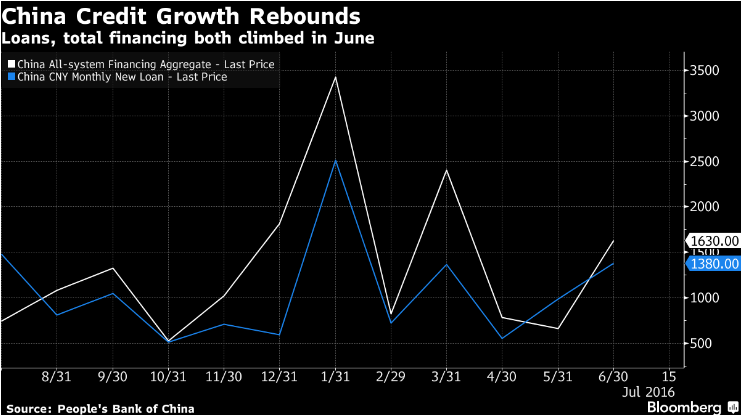

China's H1 2016 monetary data released by the People’s Bank of China (PBoC) showed that New Yuan Loan rebounded to RMB1.38trn from RMB985bn in June, much higher than market expectation (RMB1trn), resulting in a total RMB loan outstanding of RMB101.49trn (14.3% y/y). The data signal policy makers remain determined to keep old growth engines humming even at the cost of adding to debt risk.

Mortgage loans continue to be the major driver of the loan growth, reflecting the booming housing market. Household loans contributed to 52% of the total new loans. The loans extended to non-FI entities (including corporates and other entities) rebounded to RMB609bn, constituting 44% of the total loan growth.

"Money and credit remain solid. Credit data indicates monetary policy remained accommodative, without an obvious further easing," Yu Xiangrong, China International Capital Corp, Hong Kong, wrote in a note.

The divergence between M1 and M2 growth developed further, M1 money supply continued to rise faster than M2 money supply. M1, which includes bank deposits and currency in circulation, rose 24.6 percent from a year earlier, the biggest increase in six years. The broader M2, which also includes savings deposits, increased 11.8 percent, matching the May reading, but remains below the PBoC's target of 13%. The growing divergence indicated the corporates’ preference is to hold cash which signals poor growth outlook.

Separate data released by the National Bureau of Statistics on Friday showed that China's Q2 Gross Domestic Product (GDP) growth beat estimates Friday with a 6.7 percent expansion on-year in the three months through June, as a string of stimulus measures from the government and the central bank helped shore up demand. GDP was up 1.8 percent from the first quarter.

“While there was a big pick-up in retail sales, the slowdown in fixed-asset investment is a worry. Given the slide in fixed-asset investment growth, I'm inclined to keep my forecast of slowing growth over the course of the year,” said Tim Condon, chief economist for Asia at ING in Singapore.

Asian stock markets have recorded further gains after China economic data beat expectations. Australia's S&P/ASX 200 rose 0.3% to finish the day at 5,429.60 and South Korea's stock market closed 0.4% higher at 2,017.26. Hong Kong's Hang Seng closed 0.5% higher at 21,659.25 and the Shanghai Composite closed flat at 3,054.30.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal