Riksbank could start to remove negative rates in late 2017

Sep 26, 2016 12:28 pm UTC| Insights & Views Central Banks

At its latest monetary policy meeting on September 7th, the Swedens central bank left the repo rate unchanged at minus 0.50 percent and said to continue to purchase government bonds in the second half of 2016. The Riksbank...

Sep 26, 2016 12:17 pm UTC| Central Banks Economy Insights & Views

After CBRTs rate cut in last week, Moodys downgrading has been thedouble whammy for USDTRY, as the pair has been spiking considerably. President Tayyip Erdogan unsettled markets briefly on Friday when he appeared to...

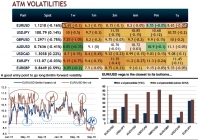

FxWirePro: Uphold EUR/USD vols derivatives owing to prospects of vega outperformance

Sep 26, 2016 11:39 am UTC| Research & Analysis Insights & Views

The EURUSD action, is characterised by relatively range-bound spot markets from last two years with only rupture of realised volatility, is not enough to support an imminent rise in volatility. EURUSD is the pair to...

Trump, Clinton and the future of global democracy

Sep 26, 2016 08:56 am UTC| Insights & Views Politics

Donald Trumps admiration for Russian President Vladamir Putin puts the U.S. perilously close to abandoning its longstanding role as democracys greatest proponent. In the process, Trump is challenging the already threatened...

Women support democracy less than men in parts of Africa – why?

Sep 26, 2016 08:52 am UTC| Insights & Views Politics

In much of the world, democracy is seen as a force for good, and in development terms, it has important implications for the welfare of citizens. Increasing the legitimacy of a democracy must by its nature happen...

FxWirePro: EUR/USD’s vega reigns at coolest spot and offers cheapest IVs among G7 FX space

Sep 26, 2016 08:16 am UTC| Research & Analysis Insights & Views

FX volatility entered a moderate regime in early 2015 but since July has come under significant pressure and is experiencing an unusually long period of stability. The current lows suggest multi-month volatility hedges, as...

Smartphones in India: how to get 1.25 billion people online

Sep 26, 2016 07:58 am UTC| Insights & Views Technology

Is it possible to connect the vast majority of Indias 1.25 billion citizens to the internet? Thats the ambition at the heart of Prime Minister Narendra Modis Digital India campaign. But if the government wants to achieve...

- Market Data