At its latest monetary policy meeting on September 7th, the Sweden's central bank left the repo rate unchanged at minus 0.50 percent and said to continue to purchase government bonds in the second half of 2016. The Riksbank asserted conditions in Sweden point to a continued rise in inflation and a drop in unemployment rates. The central bank also pointed to a potential slight rise in Sweden's repo rate in the second half of 2017, when inflation is expected to be at two per cent.

Minutes of the Sept 7th meeting released last week showed that at least half of the Swedish central bank's rate-setters now believed there was no need to extend asset purchases past December. Members consider it appropriate to raise the repo rate slowly during the second half of 2017.

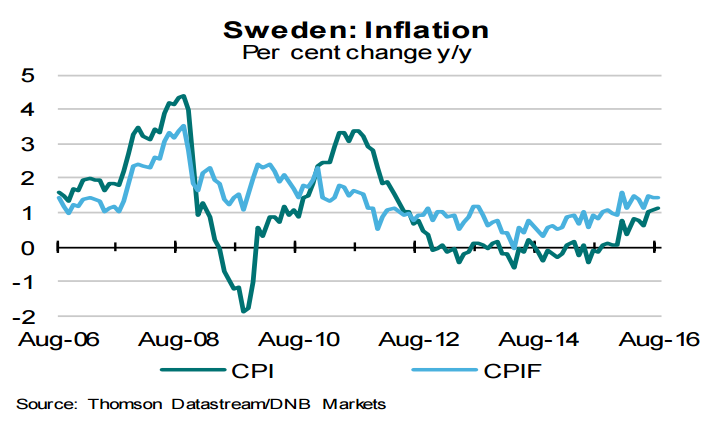

Deflation risk in Sweden is now reduced. Inflation is now rising more quickly than before. CPIF inflation in Sweden was set to approach the Riksbank's target of 2.0 percent in early 2017. Most sectors in the economy were reporting labour shortages above their long-run averages, which suggest wage growth could accelerate quite sharply, thereby pushing up wage inflation.

Despite some slowdown, growth in Sweden is still above potential. Housing investments will remain high and the influx of asylum seekers is likely to push up public spending in the short run. Low interest rates also to support private consumption. Strong domestic growth and higher energy prices support inflation. However, stronger SEK and weak economic development abroad could keep inflation subdued. That said, the probability for interventions has decreased, though, since the krona has come under depreciation pressure recently following the Brexit vote and softer growth data.

"Inflation expectations have picked up, growth is strong and monetary policy very expansionary. We don’t expect further easing in this cycle, and believe the Riksbank start to remove negative rates in the end of 2017," said DNB Markets in a report to clients.

EUR/SEK was 0.31 percent higher on the day, trading at 9.6061 at around 12:00 GMT. Technicals on the daily charts were bullishly aligned. We see scope for further upside, test of 9.6742 levels likely. 20-DMA at 9.5480 is major support on the downside, weakness only on break below.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.