FxWirePro: Ideal time for tactical hedging USD/JPY via knockout puts

May 05, 2017 10:02 am UTC| Research & Analysis Insights & Views

The FOMC is looking through softer data and is on track for a June rate hike, but we dont think that suffices to drive the dollars robustness in the months to come unless the market reconsiders the longer-term rate...

BRICS bank is offering more of the same rather than breaking the mould

May 05, 2017 08:37 am UTC| Insights & Views Economy

The New Development Bank recently held its second annual meeting in the Indian capital of New Delhi to discuss the sustainability of financing development projects in its member states. The multilateral bank was...

Alphabet's new plan to track 10,000 people could take wearables to the next level

May 05, 2017 08:32 am UTC| Insights & Views Technology Health

Verily the life sciences research arm of Google parent company Alphabet wants to track the health of 10,000 people. On April 19, the group announced that it was starting to recruit for Project Baseline, in partnership...

Why biased budget forecasts make poor politics

May 05, 2017 07:41 am UTC| Insights & Views Politics

For the last eight years, budget outcomes have consistently been much lower than previous budget forecasts. But in each year, the treasurer has again forecast a happy return to balance over the next four years....

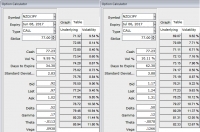

FxWirePro: Bid 1m2m NZD/JPY IVs - naked puts for aggressive bears and DPS for risk averse hedgers

May 05, 2017 07:17 am UTC| Research & Analysis Insights & Views

OTC Outlook ATM IVs of this pair is trading at 9.95% and 10.11% for 1 and 2m tenors respectively. While 1m ATM puts are trading just at 12.31% more than NPV. Please also be noted that the options with a higher IV...

May 05, 2017 06:59 am UTC| Research & Analysis Insights & Views

In New Zealand, global dairy auction numbers have produced upbeat numbers, 3.6% versus previous 3.1%, while unemployment claims have reduced from the previous 5.2 to the current 4.9% against the forecasts at 5.1%....

The Cashless Debit Card Trial is working and it is vital – here's why

May 05, 2017 06:13 am UTC| Insights & Views

The federal governments Cashless Debit Card Trial, which began in selected communities in South Australia and Western Australia from March 2016, is a significant innovation in tackling the health and socioeconomic...

- Market Data