The FOMC is looking through softer data and is on track for a June rate hike, but we don’t think that suffices to drive the dollar’s robustness in the months to come unless the market reconsiders the longer-term rate outlook. Fed hints on 1 more hike in 2017 whereas many analysts across the streets (including JP Morgan) expect minimum 2 more hikes.

While the euro may only get a modest lift from a reduction in French political uncertainty, but that should be enough to lift EURJPY and strengthen euro-satellite currencies. But we’ll be watching commodity markets, as metals melt and oil slips.

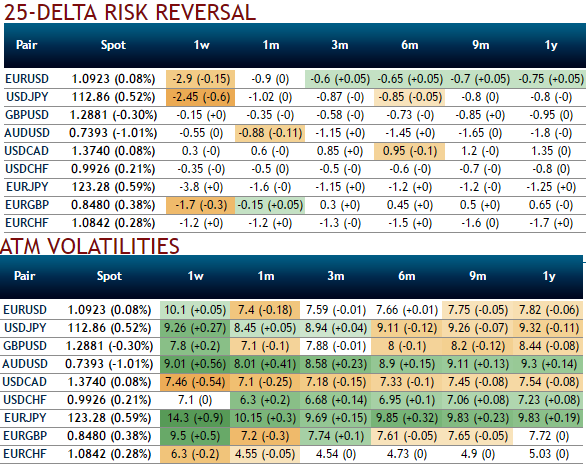

OTC outlook:

The implied volatility of ATM contracts of USDJPY are trading at around 8.45-8.91% for 1-3m tenors, the spike in IVs among G10 FX space appears to be conducive for put option holders as the delta risk reversals flashing up progressively with negative numbers that signify hedging arrangements for downside risks over the period of time.

Trade mechanism: Buy a 2m put spread strike at 111/109 with a KO at 115 on the long put. The maximum payout reached and below 109 is about six times the premium.

The rationale for the trade:

After the FOMC meeting, an even faster Fed is unlikely, eroding dollar gains potential.

Timing and entry point to sell USDJPY now are technically compelling.

USDJPY volatility is trading at its lowest level since the start of 2016.

IVs and risk reversals of this pair in OTC FX markets are indicative of bearish risks in the weeks to come.

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch