May 11, 2017 07:41 am UTC| Technicals Insights & Views

After strong support at 1.8660, bulls have managed to bounce back with sharp rallies with convincing volumes. As a result, the bullish engulfing pattern candle is traced out (refer 4H chart). Current price, for now, has...

May 11, 2017 06:51 am UTC| Central Banks Research & Analysis Insights & Views

At its May interest rate review, the Reserve Bank of New Zealand kept the Official Cash Rate (OCR) on hold at 1.75%, as expected. However, the RBNZ also concluded that developments since the February Monetary Policy...

Budget bank levy: too big to fail, not too big to take a hit

May 11, 2017 00:26 am UTC| Insights & Views Economy

The budget announcement of a 0.06% levy on a subset of bank liabilities looks arbitrary, and is certainly politically opportunistic. But it could be rationalised as a response, albeit probably not the best response, to...

These three firms own corporate America

May 11, 2017 00:15 am UTC| Insights & Views Economy Investing

A fundamental change is underway in stock market investing, and the spin-off effects are poised to dramatically impact corporate America. In the past, individuals and large institutions mostly invested in actively...

Donald Trump fires FBI director and a new national nightmare takes hold

May 11, 2017 00:08 am UTC| Insights & Views Politics

Ever since Donald Trump took office amid revelations of Russian meddling in the 2016 election and his teams connections with the Kremlin, a monumental political time-bomb has been steadily ticking. But things took an...

May 10, 2017 13:29 pm UTC| Research & Analysis Insights & Views

Macro outlook: In the UK, Politics continues to dominate the headlines, with further signs that the UK and the EU are entering the Brexit negotiations some distance apart. PM May accuses the EU of interfering with...

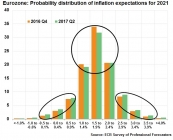

Eurozone inflation outlook improves in ECB survey, adds to the central bank's dilemma

May 10, 2017 11:59 am UTC| Insights & Views Economy Central Banks

The recently released European Central Bank (ECB) Survey of Professional Forecasters for the second quarter of 2017 shows that inflation in the eurozone will pick up in future but remain driven by volatile food and energy...

- Market Data