The recently released European Central Bank (ECB) Survey of Professional Forecasters for the second quarter of 2017 shows that inflation in the eurozone will pick up in future but remain driven by volatile food and energy prices. An above potential growth should cause a narrowing of the still negative output gap and eventually cause a pick-up in inflation. As the eurozone economy strengthens and inflation gradually picks up, the issue of how and when the ECB should exit quantitative easing will continue to be to the forefront.

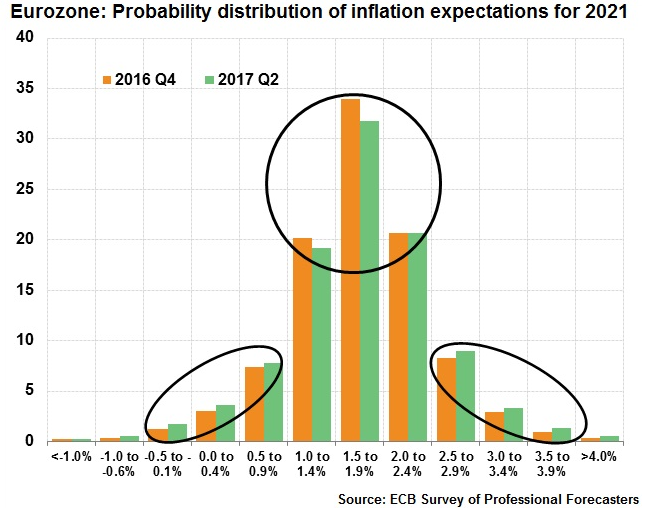

According to the survey, in 2017, eurozone inflation is expected to rise at an average rate of 1.6 percent, up from a previous forecast of 1.4 percent. Forecasters expect 1.5 percent rise in 2018 and 1.7 percent in 2019. Further out, price growth is expected reach 1.8 percent by 2021, around the ECB's target of close to, but below 2.0 percent per year. The probability distribution report showed long-term inflation forecasts (that is for 2021) were flatter than six months ago, suggesting a slight increase in long-term inflation uncertainty.

For the first time since 2012, a gauge of long-term inflation expectations - the five-year, five-year breakeven forward rate, which the ECB follows closely - is lagging monthly consumer price growth, which hit 2 percent in February. However, analysts are not convinced inflation will stay there. The central bank has said that the headline inflation is being pushed up by price changes in volatile items like food and energy, and pressure from other sources such as higher wages remains weak.

ECB president Draghi expects the core inflation excluding the fastest-changing elements will take longer to approach the target, suggesting that the ECB's support will be needed for longer. The forecasters were more optimistic than the central bank, which currently projects core inflation of 0.9 percent this year. The survey last week suggested that core inflation will reach 1.1 percent this year, followed by 1.3 percent next year and 1.5 percent in 2019, still well short of the ECB's goal.

Hawkish voices on the ECB's governing council are already pushing for an end to the 60-billion-euro ($65-billion) per month bond-buying programme and a rise in historic low interest rates. Policymakers will have new staff inflation forecasts available at their next monetary policy meeting in June. Analysts expect Draghi to use his press conference following that gathering to hint at a gradual exit from mass bond-buying next year.

EUR/USD was trading lower on fed rate hike hope, focus also remains on the ECB President Draghi’s speech amid a data-light EUR calendar. EUR/GBP extending downside for 4th straight session, trades below 20-DMA at 0.8440. Markets focus on BoE's Super Thursday, investors wary to carry big bets heading into the key event risk.

FxWirePro's Hourly EUR Spot Index was at -27.4523 (Neutral), while Hourly GBP Spot Index was at 59.1562 (Neutral) at 1030 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data