Business managers in France project manufacturing industry’s investment to fall 1 pct in 2019

Nov 08, 2018 14:39 pm UTC| Commentary

The business managers in France surveyed in October 2018 project that investment in the manufacturing industry will decline by 1 percent next year in nominal terms. They expect a 4 percent rise next year in their...

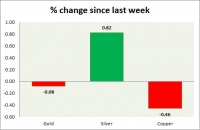

Commodities snapshot (precious & industrial)

Nov 08, 2018 13:43 pm UTC| Commentary

The metal pack is mixed today. The performance this week at a glance in the chart table - Gold: Gold is struggling along with the USD. Todays range $1228-1221 Gold is currently trading at $1223/troy ounce....

Nov 08, 2018 13:32 pm UTC| Commentary

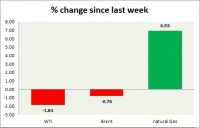

Energy pack is mixed in todays trading. Weekly performance at a glance in chart table, Oil (WTI) Oil price is moving down despite Middle East tensions as inventories continue to build amid sharply higher...

Bank Negara Malaysia keeps interest rate on hold, likely to maintain neutral tone through 2019

Nov 08, 2018 13:24 pm UTC| Commentary Central Banks

The Malaysian central bank, Bank Negara Malaysia, kept its Overnight Policy Rate on hold at 3.25 percent, as was widely anticipated. The central bank maintained that the global growth continues albeit with signs of...

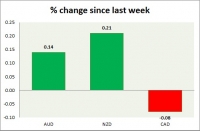

Currency snapshot (commodity pairs)

Nov 08, 2018 13:22 pm UTC| Commentary

Dollar index trading at 96.22 (+0.23%) Strength meter (today so far) Aussie +0.14%, Kiwi +0.21%, Loonie -0.08% Strength meter (since last week) Aussie +0.14%, Kiwi +0.21%, Loonie -0.08% AUD/USD Trading at...

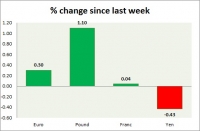

Currency snapshot (major pairs)

Nov 08, 2018 13:15 pm UTC| Commentary

Dollar index trading at 96.23 (+0.11%) Strength meter (today so far) Euro -0.11%, Franc -0.10%, Yen -0.11%, GBP -0.22% Strength meter (since last week) Euro +0.30%, Franc -0.29%, Yen -0.08%, GBP +0.42% EUR/USD...

RBNZ monetary policy: Assessing future bias

Nov 08, 2018 12:49 pm UTC| Commentary Central Banks

At todays meeting, Reserve bank of New Zealand (RBNZ) kept monetary policy unchanged with overnight cash rate at 1.75 percent. Lets see in the monetary policy, how the bias stands for future actions, The pick-up...

- Market Data