Fed Semi annual testimony, positive description of US labour market

Jul 16, 2015 03:33 am UTC| Commentary

The description of recent developments in the labour market and growth in general was also positive, although indicators suggest that there is still some slack in the labour market. On inflation, the Fed also seems only...

Fed Chair Yellen July testimony, more upbeat than usual

Jul 16, 2015 03:28 am UTC| Commentary

In the July semi-annual Monetary Policy Report to Congress, Chair Janet Yellen reiterated the message from her speech on Friday that a first fed funds rate hike this year is likely to be appropriate. In general, the...

Singapore June data shows rebound in electronics

Jul 16, 2015 03:23 am UTC| Commentary

Non-oil domestic exports expanded 4.7% y/y in June. However, on a m/m sa basis, exports declined 2.4%, consistent with our expectation for a further m/m moderation from the March surge in and reflecting a larger seasonal...

Chinese data beat expectations, with Q2 GDP at 7.0% YoY

Jul 16, 2015 02:16 am UTC| Commentary

Chinese data beat expectations, with Q2 GDP at 7.0% YoY, which prompted Chinese stocks to close lower, as good news means no more stimulus: The Shanghai market was -3.0% and a swathe of individual stocks closed limit down...

Nickel: break above 12200/12500 still needed to suggest a meaningful recovery

Jul 16, 2015 01:06 am UTC| Commentary

Break below 15Y trend has accelerated the down move in Nickel and it has achieved our target (10300). It took support at the perennial graphic level of 10500/200. Nickel has embarked into a rebound but it will take a break...

Jul 16, 2015 00:51 am UTC| Commentary

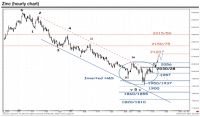

Zinc hit the multi-year triangle support (1950/37), also the 76.4% retracement of 2013- 2014 up move where it formed a weekly long-legged Doji. Weekly and daily indicators are also near support suggesting 1950/37 is...

Aluminium: is confirming an inverted H&S

Jul 16, 2015 00:45 am UTC| Commentary

Aluminium has pulled back towards lower limit of multi-year downward pointing triangle 1650/1600. Monthly RSI is holding a horizontal support suggesting 1650/1600 is a relevant support zone. Multiyear trend at 1750/1785...

- Market Data