Brazil: recession, deficits and downgrades

Oct 16, 2015 05:17 am UTC| Commentary Economy

The country is seen in a sequence of economic recession leading to fiscal deficits in the next years, putting gross debt above the 70% of GDP level and triggering rating downgrades, a sequence that the agency also cited as...

US jobless claims at post-recession lows in October

Oct 16, 2015 05:17 am UTC| Commentary

Initial jobless claims in US fell to 255k in the week ending October 3, printing lower than expectations (270k) in a return to the post-recession low first reached on July 18. Prior-week claims were revised down 1k to...

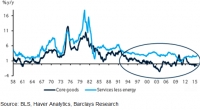

US CPI declines as energy drag continues

Oct 16, 2015 05:14 am UTC| Commentary

US CPI declined for the second month running in September. Energy prices were the only drag on headline CPI, while core and food prices made positive contributions. Headline CPI fell 0.2% m/m in seasonally adjusted...

Brazil's negative 2016 budgetary piece continues to show its effects

Oct 16, 2015 05:13 am UTC| Commentary Economy

The decision of Brazils government to send to Congress the 2016 budget by late August not only triggered SPs to move the sovereigns rating to non-investment grade, but also suggested to Fitch Ratings another setback to...

Oct 16, 2015 05:08 am UTC| Commentary

Total social financing (TSF) shows a strong pickup in September. TSF registered at CNY1.3trn in September, up from trn in July (or 14.5 % y/y). Month on month, the improvement in TSF was led by a notable increase in new...

US' core inflation strength returns

Oct 16, 2015 05:07 am UTC| Commentary

US core services prices returned to their trend of recent month, rising a solid 0.3% m/m. Shelter, including rent and OER, supported the strength in core services. Other categories such as medical care and transportation...

China's household loans likely to rise further

Oct 16, 2015 05:02 am UTC| Commentary

RMB new loans growth posted a strong rebound in September, led by medium-long term loans. RMB new loans were CNY1050bn, up from CNY810bn in August and above consensus expectation of CNY900bn. It is encouraging to see...

- Market Data