US CPI declined for the second month running in September. Energy prices were the only drag on headline CPI, while core and food prices made positive contributions. Headline CPI fell 0.2% m/m in seasonally adjusted terms.

Core CPI was slightly stronger than expected at +0.2% m/m. The NSA CPI index came in at 237.945, higher than expectations. Energy prices declined 4.7% m/m, while food prices rose 0.4% m/m. On a y/y basis, total CPI was flat and core CPI rose 1.9%.

Following the decline in wholesale energy prices in recent months, gasoline and other energy prices were a drag on headline CPI. However, their effect is expected to be transitory and headline CPI to start increasing on a m/m basis at the end of this year.

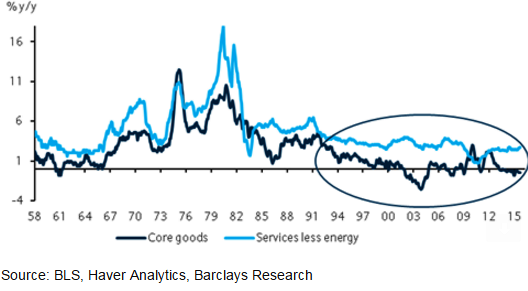

"The view that the underlying trend in consumer prices remains benign, especially for services inflation, although a strong upward trend is not expected to emerge in the near term", opines Barclays.

In particular, core goods prices are expected to remain a drag, driven by the renewed decline in commodity prices and the recent surge in the value of the dollar.

US CPI declines as energy drag continues

Friday, October 16, 2015 5:14 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed