U.S. construction spending likely quickened in September

Nov 02, 2015 04:55 am UTC| Commentary

Construction spending of the U.S. for September is scheduled to release today. Powered by stepped-up spending on private residential dwellings (2.0%), the nominal value of new construction of Unites States put-in-place...

Korea's larger current account surplus on back of goods surplus

Nov 02, 2015 04:53 am UTC| Commentary

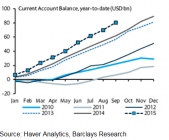

Koreas current account surplus widened to USD10.6bn in September, above forecasted. The wider surplus was primarily due to the larger goods surplus, which offset a slight deterioration in the primary income surplus and the...

BOK likely to refrain from more accomodation in Q4

Nov 02, 2015 04:50 am UTC| Commentary

The broad trend of Koreas weak external demand but stronger domestic services activity remains unchanged. The stronger pickup in Q3 GDP supported by resurgent September IP and export volume partly reflects payback for...

Indonesia's overall demand remains a major concern

Nov 02, 2015 04:46 am UTC| Commentary

Indonesias demand conditions (both domestic and external) remain weak and the weakness is expected to persist for some more time. During the quarter ending June 2015, household demand growth fell below 5% for the first...

Nov 02, 2015 04:16 am UTC| Commentary Central Banks

China official manufacturing PMI remained flat at 49.8 in October, below expectation. On the breakdown, the pickup in new orders (to 50.3 from 50.2) was offset by the decline in production (to 52.2 from 52.3). Notably,...

Some positive factors to sustain Korea's production

Nov 02, 2015 03:55 am UTC| Commentary Economy

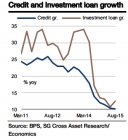

Korean exports fell 15.8% y/y in October, worse than expected, the largest decline in the headline rate this year, precipitated by large falls in shipments of petrochemicals, auto parts, steel and vessels, as well as high...

USD likely to feel upward pressure in months to come

Nov 02, 2015 03:51 am UTC| Commentary

The USD should continue gaining ground as the probability of a lift-off no later than March increases while market volatility continues to decline. The non-farm payroll report on Friday should support this. A...

- Market Data