Korean exports fell 15.8% y/y in October, worse than expected, the largest decline in the headline rate this year, precipitated by large falls in shipments of petrochemicals, auto parts, steel and vessels, as well as high base last year.

On a seasonally adjusted m/m basis, exports fell 6.1% after climbing 9.1%, alternating between contraction and growth and a sign of fragile producer confidence in the global outlook.

There was also a strong element of payback in October, after strong September pre-shipments ahead of Chuseok and Golden Week holidays in China. Today's print confirms that the underlying trend remains soft, with overall exports down 7.5% YTD.

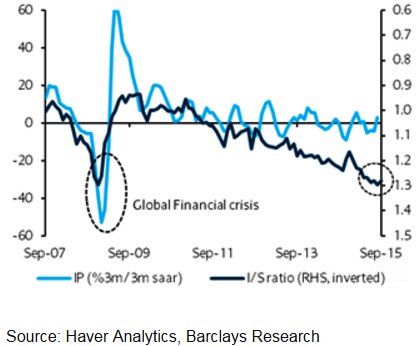

Indeed, on a per-day basis, October exports fell even more sharply, dropping 17.6% y/y, because this October had half a working day more. The key concern is still the high excess inventories, with the inventory/shipment ratio, which came in at 1.28x in September, remaining close to the 1.30x peak reached in December 2008 during the global financial crisis.

However, according to Barclays, beyond October, there are some positive factors seen that could sustain production in the last two months of Q4:

1) Stronger demand in the US for consumer electronics as the start of year-end festive demand is being approached

2) The gradual destocking of inventories

3) A ramp up in 3D memory chip output by Korean companies in China.

Some positive factors to sustain Korea's production

Monday, November 2, 2015 3:55 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Australia’s Corporate Regulator Urges Pension Funds to Boost Technology Investment as Industry Grows

Australia’s Corporate Regulator Urges Pension Funds to Boost Technology Investment as Industry Grows  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off