PMI indicates stabilization in China's manufacturing sector

Nov 02, 2015 07:40 am UTC| Commentary

Chinas official manufacturing PMI remained unchanged in October at 49.8. The private sector Caixin/Markit manufacturing PMI was firmer at 48.3 from 47.2 in September. As a whole, the readings suggest that the manufacturing...

Further ECB easing likely in December

Nov 02, 2015 07:32 am UTC| Commentary Central Banks

In an interview published Saturday by the Italian paper Il Sole 24 Ore, ECB President Draghi said the ECB would take all actions necessary if they are convinced that the medium term inflation objective is at risk. At...

Upside risk likely for USD/CAD in weeks ahead

Nov 02, 2015 07:22 am UTC| Commentary

In Canada, Octobers RBC manufacturing PMI will be released today. This has declined over the past three months (last 48.6), and a weak reading this week would signal further trouble ahead. The labour market, in contrast,...

CBR to review its key rates in December meeting

Nov 02, 2015 07:13 am UTC| Commentary Central Banks

After the Bank of Russia Board of Directors decided to maintain the key rate at 11% in September, the CBR remained in wait-and-see mode. A still volatile rouble and the corresponding high inflation risks weigh on the CBR....

China's PMI Indices suggests economy faces strong headwinds

Nov 02, 2015 07:11 am UTC| Commentary

Chinas PMI indices, especially the Caixin/Markit PMI, suggested that the economy, albeit still facing strong headwinds, could be moving towards stabilisation. This is likely a result of the aggressive policy from Beijing...

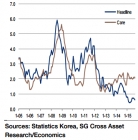

S. Korean inflation likely to rebound due to base effects

Nov 02, 2015 07:03 am UTC| Commentary

Both South Koreas headline and core inflation are likely to have rebounded on a year-on-year basis in October due to base effects. Energy prices should continue to decline, although the pace of decline is likely to ease...

Australian mortgage rate hike too small to trigger policy rate cut

Nov 02, 2015 06:58 am UTC| Commentary

Over the past two weeks, all Big Four domestic lending banks in Australia have raised their variable mortgage rates by between 15bp and 20bp. This undeniably has the effect of tightening monetary conditions. The...

- Market Data