Commodities snapshot (precious & industrial)

Dec 07, 2015 14:42 pm UTC| Commentary

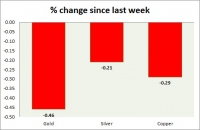

Metal pack is red today. Performance this week at a glance in chart table - Gold - Gold is marginally down over profit bookings. Todays range $1078-1087 Gold is currently trading at $1080/troy ounce. Immediate...

Currency snapshot (commodity pairs)

Dec 07, 2015 14:05 pm UTC| Commentary

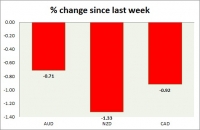

Dollar index trading at 98.81 (+0.47%) Strength meter (today so far) - Aussie -0.71%, Kiwi -1.33%, Loonie -0.92%. Strength meter (since last week) - Aussie -0.71%, Kiwi -1.33%, Loonie -0.92%. AUD/USD - Trading at...

Dec 07, 2015 13:51 pm UTC| Commentary

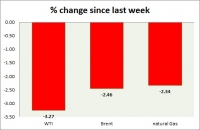

Energy pack is in red today. Weekly performance at a glance in chart table. Oil (WTI) - WTI is sharply down as OPEC scrapped its ceiling in Fridays meeting. Todays range $40-$38.7 WTI is currently trading at...

Goldman Sachs revises its Euro sub-parity call

Dec 07, 2015 13:05 pm UTC| Commentary

United States largest investment followed in the footsteps of many analysts and banks revising their target for Euro/Dollar parity. We have also revised our call for parity from near term to medium term. We in the near...

Energy takes toll on Norwegian manufacturing

Dec 07, 2015 12:42 pm UTC| Commentary Economy

Fall in energy prices, Norways top exports is taking heavy toll in overall a manufacturing, extraction and mining sector. This slowdown is likely to worsen outlook for the country and its job market. Norway notably...

No sign of improvement in Taiwan exports

Dec 07, 2015 12:41 pm UTC| Commentary Economy

Taiwans exports are declined by 16.9% year on year in November against -11.0% in October. This is the largest fall since August 2009. On a month on month seasonally adjusted shipment exports are dropped by 3.8%., which...

FxWirePro: Euro outlook – upside possibilities in short term

Dec 07, 2015 11:49 am UTC| Commentary

After Thursdays massive recovery in Euro, post European Central Banks (ECB), larger than ever disappointing stimulus, we are scaling back out near term outlook and call for parity. However it is important to distinguish...

- Market Data