Brexit and China fear pounds Pound

Jan 07, 2016 12:01 pm UTC| Commentary

Like we said, as 2016 approached, Brexit came into focus of investors. We even included Britains European Union referendum as one of the top macro-themes. David Cameron has promised voters, when coming to power, he will...

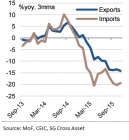

Rebound expected in Taiwan’s December Trade Data

Jan 07, 2016 11:29 am UTC| Commentary

With the demand from China deteriorating and shipments to the US decelerating, Taiwans exports slumped by 16.9% YoY in November, the fastest contraction ever since the Great Financial Crisis. As the year end shipments...

Minutes suggests FED worries on weak inflation

Jan 07, 2016 11:10 am UTC| Commentary Central Banks

Federal Open Market Committee (FOMC) hikes interest rates by 25 basis points for first time since 2006 in last policy meeting in December, but minutes from that meeting shows policy makers remain greatly concerned on...

China’s FX reserve shrank by record in December and in 2015

Jan 07, 2016 10:29 am UTC| Commentary Central Banks

China suffered biggest monthly drop in foreign exchange reserve in December, leading to largest annual drop ever. In December, Chinas FX reserve dropped by -$107.9 billion, bringing total annual shrinkage to $512.66...

French Industrial Production likely to fall in November

Jan 07, 2016 10:01 am UTC| Commentary

With an increase in the energy production component, the French Industrial Production in October rose by 0.5 %, which was far better than expected. However, with a drop in both machinery equipment and transport equipment,...

Strong German Trade Data expected in November

Jan 07, 2016 09:35 am UTC| Commentary

Rebound in Germanys Novembers exports and imports are expected after Octobers weak data disappointed the market. Imports are expected to increase on growing domestic economy and strong income growth, while exports are seen...

South Africa's SARB is a robust anchor but may face more acute challenges

Jan 07, 2016 09:33 am UTC| Commentary Central Banks

The biggest hurdle in front of SARB is lower forex reserve which is just over USD40bn only and ZAR weakness. The weakening of the National Treasury leaves the SARB to lower its interest rates. In general Central...

- Market Data