Weakness in Canadian economy due to oil price rout temporary?

Jan 21, 2016 05:16 am UTC| Commentary

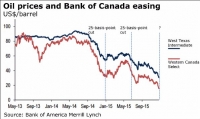

The Bank of Canada has stated that the additional decline in oil prices has setback the Canadian economy for a temporary period of time. According to the central bank, the economys return to above-potential growth will now...

Kiwi falls despite positive manufacturing index

Jan 21, 2016 04:22 am UTC| Commentary

New Zealands manufacturing sector rose from the previous month and continued to revel in the expansionary zone last month, according to an industry gauge. The Business NZ-BNZ Performance of Manufacturing Index (PMI) rose...

Gold surpasses $1,100 as traders chasing safety

Jan 21, 2016 03:50 am UTC| Commentary

The price zoomed back above the critical level for the second time in the past two weeks, as risky assets fall out of favour with investors worried over an uncertain outlook for the global economy. Futures for gold rose...

Most Asian markets enjoying positive opening

Jan 21, 2016 03:19 am UTC| Commentary

Asian stocks opened with slight gains after oil price falls forced European and US indexes to suffer a tumble. The benchmark Nikkei 225 has risen 0.93% to 16,568.07 since the open. The Shanghai Composite index was 0.92%...

ECB to reiterate dovish guidance

Jan 21, 2016 02:49 am UTC| Commentary Central Banks

The ECB Governing Council meets today. The benchmarks rates are likely to be left steady, guidance will be dovish with an eye on containing the EUR/USD rebound and defend pressure to ease policy further. Policymakers...

Thailand's 5% export growth target unlikely to be met this year

Jan 21, 2016 02:33 am UTC| Commentary

Thailand maintains its 5% export growth target this year. Note that, on sequential terms, there has been no improvement in export growth at the end of 2015. Given the 5% contraction last year and zero growth in both 2013...

A stable monetary policy stance likely to prevail for now in Malaysia

Jan 21, 2016 02:19 am UTC| Commentary

Bank Negara is likely to maintain the Overnight Policy Rate (OPR) at 3.25% in todays meeting. It is all about balancing the risks between growth and inflation. And CPI inflation has remained at elevated level while...

- Market Data