Feb 01, 2016 14:50 pm UTC| Commentary

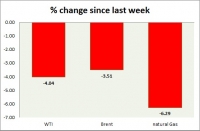

Energy pack is red today. Weekly performance at a glance in chart table. Oil (WTI) - WTI in sharp fall today as glut concern back on spotlight. Todays range $32.1-34.2 WTI is currently trading at $32.1/barrel....

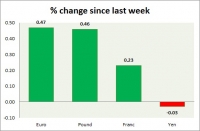

Currency snapshot (major pairs)

Feb 01, 2016 14:37 pm UTC| Commentary

Dollar index trading at 99.28 (-0.31%). Strength meter (today so far) - Euro +0.47%, Franc +0.23%, Yen -0.03%, GBP +0.46% Strength meter (since last week) - Euro +0.47%, Franc +0.23%, Yen -0.03%, GBP +0.46% EUR/USD...

Chinese data supports call for further stimulus from PBoC?

Feb 01, 2016 14:36 pm UTC| Commentary Central Banks

Data released over the weekend showed that Chinas official factory PMI slipped for a sixth consecutive month to a 3 year low of 49.4 in January, compared with a median expectation of 49.6. While the private Caixin survey...

German 5 year yield dive to new record low as Cœuré suggests easing

Feb 01, 2016 13:34 pm UTC| Commentary

German 5 year yield has plunged into new record low today. German 5 year Yield traded as low as -0.32%, before recovering ground and being positive for the day. European Central Bank (ECB) executive board member Benot...

US personal consumption expenditure preview

Feb 01, 2016 12:44 pm UTC| Commentary Economy

Personal consumption, income data along with PCE price index would be released from US at 13:30 GMT. Why it matters? Personal consumption and income data provide information on consumer sentiment. Consumers tend...

BoK likely to cut rate by 25bp in Q1

Feb 01, 2016 12:34 pm UTC| Commentary

S. Koreas December current account surplus reduced to 7.5 billion USD as compared to Novembers print of 9.9 billion USD as a result of high deficits on the primary income and services accounts. This offset the goods...

10-year JGB closes in on negative territory

Feb 01, 2016 12:26 pm UTC| Commentary

While bank of Japans (BOJ) negative rate charm is fading over benchmark stock index Nikkei, which is marginally down -0.5% today and Yen is flat for the day, Japanese government bonds are continuing their advance. Since...

- Market Data