OPEC still producing way too much oil

Feb 01, 2016 16:39 pm UTC| Commentary

The ongoing discussion since mid last week about coordinated production cuts by Russia and OPEC saw oil prices close the trading week on Friday with significant gains. Brent was at one point trading at USD 36 per barrel,...

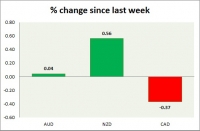

Currency snapshot (commodity pairs)

Feb 01, 2016 16:12 pm UTC| Commentary

Dollar index trading at 99.06 (-0.53%) Strength meter (today so far) - Aussie +0.04%, Kiwi +0.56%, Loonie -0.37% Strength meter (since last week) - Aussie +0.04%, Kiwi +0.56%, Loonie -0.37% AUD/USD - Trading at...

Declining commodity prices to keep pressure on EM assets

Feb 01, 2016 16:11 pm UTC| Commentary

Emerging Markets are largely net exporters of commodities. Hence if the commodity prices keep declining, EM assets are likely to remain under pressure. Currency market stabilisation will be key to assess investor appetite...

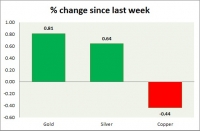

Commodities snapshot (precious & industrial)

Feb 01, 2016 15:45 pm UTC| Commentary

Metal pack is mixed today. Performance this week at a glance in chart table - Gold - Gold is up as risk aversion returns. Todays range $1115-1129 Gold is currently trading at $1126/troy ounce. Immediate support lies...

EM credit defaults likely to rise in 2016

Feb 01, 2016 15:42 pm UTC| Commentary

Corporate leverage has increased considerably in several EM countries, especially US dollar-denominated credit. IMF data shows that EM corporate debt has risen from less than 50% of GDP in 2008 to almost 75% now. The US...

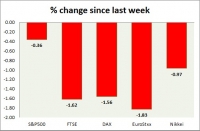

Feb 01, 2016 15:20 pm UTC| Commentary

Equities are all red in todays trading. Kindly note all instruments mentioned here are CFDs, whose values might differ from cash or future traded. Performance this week at a glance in chart table - SP 500 - SP 500,...

EM composite PMI falls in Dec, outlook sluggish

Feb 01, 2016 15:01 pm UTC| Commentary

Emerging markets have had a difficult start to 2016. Data showed that composite PMI for Emerging markets dipped to 49.5 in December. The IMF also revised its 2016 EM growth forecast to 4.3% earlier in Jan, and further GDP...

- Market Data