BOK rate decision likely to be a close call

Feb 15, 2016 14:50 pm UTC| Commentary Central Banks

The Bank of Korea meets tomorrow to decide interest rates and expectations are for the BOK to turn dovish. The probability of a rate cut is currently high due to a weaker global manufacturing index, lower stock prices and...

Weak Jan China trade data highlights sluggish demand and growth momentum

Feb 15, 2016 14:32 pm UTC| Commentary Economy

Chinas trade balance for January 2016 came in at CNY 406.2bn vs +389.01bn expected, but details showed a collapse in exports/imports. Exports contracted by -11.2% y/y (Dec 2015: -1.4%), the largest decline since March...

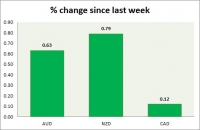

Currency snapshot (commodity pairs)

Feb 15, 2016 13:17 pm UTC| Commentary

Dollar index trading at 96.51 (+0.41%) Strength meter (today so far) - Aussie +0.63%, Kiwi +0.79%, Loonie +0.12% Strength meter (since last week) - Aussie +0.63%, Kiwi +0.79%, Loonie +0.12% AUD/USD - Trading at...

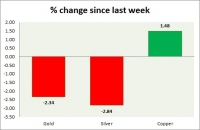

Commodities snapshot (precious & industrial)

Feb 15, 2016 13:07 pm UTC| Commentary

Metal pack is mixed today. Performance this week at a glance in chart table - Gold - Gold is down over fading risk aversion. Todays range $1207-1239 Gold is currently trading at $1209/troy ounce. Immediate support...

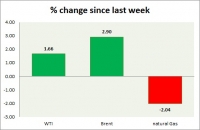

Feb 15, 2016 13:01 pm UTC| Commentary

Energy pack is mixed today. Weekly performance at a glance in chart table. Oil (WTI) - WTI started the week on positive note. Todays range $28.9-30.2 WTI is currently trading at $30/barrel. Immediate support lies at...

Eurozone’s net trade unlikely to boost GDP growth this year

Feb 15, 2016 12:29 pm UTC| Commentary

Eurozones seasonally-adjusted goods trade surplus declined to 21.0 billion in December as compared to 22.6 billion in November. The decline came in as exports fell 0.3%, while imports grew 0.8%; however, the surplus was...

What can support USD in near term?

Feb 15, 2016 11:48 am UTC| Commentary

Part of the answer lies in Markets move since Friday. Dollar index, after reaching as low as 95.5 area, recovered sharply and currently trading at 96.37, up 0.28% for the day. So what has been supportive of...

- Market Data