Currency snapshot (major pairs)

Mar 10, 2016 13:13 pm UTC| Commentary

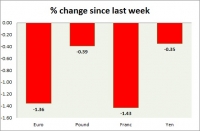

Dollar index trading at 97.95 (+0.75%) Strength meter (today so far) - Euro -1.3%, Franc -0.98%, Yen -0.79%, GBP -0.23% Strength meter (since last week) - Euro -1.36%, Franc -1.43%, Yen -0.35%, GBP -0.39% EUR/USD...

Bank of Russia likely to keep key rate on hold in 2016 on elevated inflation risks, vulnerable ruble

Mar 10, 2016 13:03 pm UTC| Commentary Central Banks

The Bank of Russia is expected to keep its key rate on hold at 11% on 18 March, after it lowered the rate by 600bps in 2015. The authorities would like the central bank to further ease policy due to weak domestic demand...

ECB fires bazooka defying expectations

Mar 10, 2016 13:01 pm UTC| Commentary Central Banks

It seems we were conservative in our estimates, while European Central Bank wasnt in their actions. Actions from ECB Main refinance rates were cut by 0.05% to zero, so its basically free money for banks and...

Fund flow analysis: EM equity MF

Mar 10, 2016 12:33 pm UTC| Commentary

Compared to developed markets, longer term mutual fund size is very much smaller for emerging markets, except for that of China. Nevertheless trend is quite clear from whatever smaller sized data we got in our hands. 2015...

US import prices likely slowed in February as foreign product prices dropped

Mar 10, 2016 12:32 pm UTC| Commentary

US impot price index likely fell by 0.9% in February due to widespread drops in foreign product prices and certain stabilization in global petroleum prices. Februarys decline will be a slightly slower pace as compared with...

Fund flow analysis: DM equity MF

Mar 10, 2016 12:10 pm UTC| Commentary

In our previous fund slow analysis of Global ETFs, major trends of 2016 was quite clear, as investors pulled money away from riskier assets in January to safe havens and that trend is now fading with once again investors...

BoE to keep interest rates on hold in March, likely to raise in Q4 2016

Mar 10, 2016 12:10 pm UTC| Commentary

The Bank of England is likely to unanimously vote to keep interest rates on hold during the monetary policy meeting in March. The MPC might have had relief from the recent short-squeeze in energy and commodities, but...

- Market Data