May 10, 2016 15:03 pm UTC| Commentary

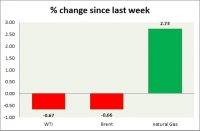

Energy pack is green in todays trading. Weekly performance at a glance in chart table. Oil (WTI) WTI is sharply higher today but intraday swings persist. Todays range $43-44.5 WTI is...

Commodities snapshot (precious & industrial)

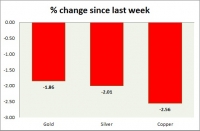

May 10, 2016 14:31 pm UTC| Commentary

Metal pack is up today. Performance this week at a glance in chart table - Gold Gold is only marginally higher today on weaker Dollar. Todays range $1259-1268 Gold is currently trading at $1263/troy...

Currency snapshot (major pairs)

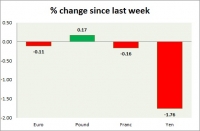

May 10, 2016 14:13 pm UTC| Commentary

Dollar index trading at 94.13 (-0.02%) Strength meter (today so far) Euro -0.01%, Franc -0.27%, Yen -0.64%, GBP +0.22% Strength meter (since last week) Euro -0.11%, Franc -0.16%, Yen -1.76%, GBP +0.17% EUR/USD...

Currency snapshot (commodity pairs)

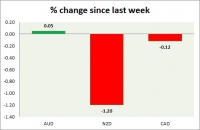

May 10, 2016 14:00 pm UTC| Commentary

Dollar index trading at 94.14 (+0.01%) Strength meter (today so far) Aussie +0.71%, Kiwi -0.31%, Loonie +0.3% Strength meter (since last week) Aussie +0.05%, Kiwi -1.20%, Loonie -0.12% AUD/USD Trading at...

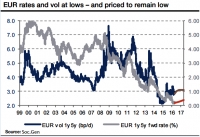

FxWirePro: Drivers of hedging euro against higher rates and risks associated

May 10, 2016 13:25 pm UTC| Commentary

As ECB keeps maintaining negative rate strategy and active asset purchase programme, we advocated rates strategy as follows in our recent write up: Buying EUR 2y5y ATMF payers vs selling 1y1y5y ATMF mid-curve payers...

Briferendum Series: NIESR warns 20% drop in Sterling

May 10, 2016 13:23 pm UTC| Commentary

United Kingdoms well respected National Institute for Economic and Social Research (NIESR) has issued warning that Pound Sterling could fall as much as 20% if the Kingdom votes to exit European Union. In addition to that...

NOK likely to remain weak in near term, EUR/NOK to trade at 9 by 2016-end

May 10, 2016 13:02 pm UTC| Commentary

The Norwegian central bank, earlier in 2016, cut its key interest rate to record low of 0.5% amidst current indications of weak activity in economy. Intentions to invest in Norway have been lowered sharply and are not...

- Market Data