Dollar index trading at 94.13 (-0.02%)

Strength meter (today so far) – Euro -0.01%, Franc -0.27%, Yen -0.64%, GBP +0.22%

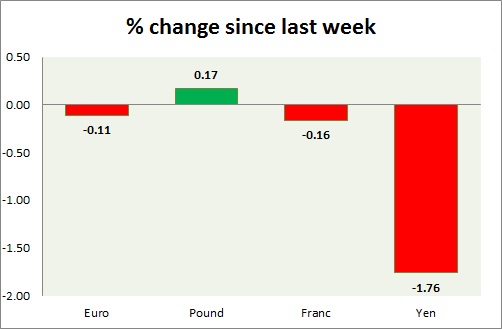

Strength meter (since last week) – Euro -0.11%, Franc -0.16%, Yen -1.76%, GBP +0.17%

EUR/USD –

Trading at 1.14

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Buy

Support

- Long term – 1.08, Medium term – 1.115, Short term – 1.125

Resistance –

- Long term – 1.2, Medium term – 1.17, Short term – 1.17

Economic release today –

- NIL

Commentary –

- Euro is consolidating around 1.14. Our longer term target for Euro to reach as high as 1.20 against Dollar.

GBP/USD –

Trading at 1.442

Trend meter –

- Long term – Buy, Medium term – Buy, Short term – Range/Sell

Support –

- Long term – 1.4, Medium term – 1.4, Short term – 1.427

Resistance –

- Long term – 1.47, Medium term – 1.467, Short term – 1.467

Economic release today –

- Trade balance came at -£3.8 billion.

Commentary –

- Pound is best performer today and only major positive against Dollar.

USD/JPY –

Trading at 108.2

Trend meter –

- Long term – Sell, Medium term – Range/ Sell, Short term – Sell

Support –

- Long term – 98.5, Medium term – 102.8, Short term – 105

Resistance –

- Long term – 121, Medium term – 115, Short term – 111.2

Economic release today –

- NIL

Commentary –

- Yen is worst performer this week as finance minister Taro Aso talked intervention. Active call – Buy Yen @119.5 with stop loss around 123.8 and target at 114 and 110, 108.9 and 98.5 First three target reached, new target 90 added.

USD/CHF –

Trading at 0.969

Trend meter –

- Long term – Buy, Medium term – Range, Short term – Range/Sell

Support –

- Long term – 0.905, Medium term – 0.927, Short term – 0.95

Resistance –

- Long term – 1.037, Medium term – 1.01, Short term – 0.98

Economic release today –

- Unemployment rose to 3.5% in April from 3.4% prior.

Commentary –

- Franc is down against both Dollar and Euro. We expect Franc to strengthen against Dollar to as high as 0.9 area.