Aug 05, 2016 13:11 pm UTC| Commentary

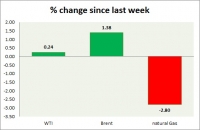

Energy pack is mixed in todays trading. Weekly performance at a glance in chart table. Oil (WTI) WTI gained back some grounds and on its way to close positive for the week. Active call WTI is likely to drop...

Chile’s exports likely to have recovered in July

Aug 05, 2016 13:08 pm UTC| Commentary

Chiles exports are expected to have recovered in the month of July. Last year, the trade surplus dropped to nearly half of the 2014 level due to the quickening fall in exports that dropped 17 percent year-on-year on...

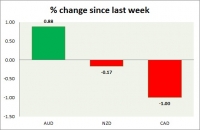

Currency snapshot (commodity pairs)

Aug 05, 2016 13:01 pm UTC| Commentary

Dollar index trading at 96.13 (+0.36%) Strength meter (today so far) Aussie +0.09%, Kiwi +0.07%, Loonie -1.00% Strength meter (since last week) Aussie +0.88%, Kiwi -0.17%, Loonie -1.00% AUD/USD Trading at...

US Treasuries plunge on better than expected non-farm payrolls

Aug 05, 2016 12:55 pm UTC| Commentary

The US Treasuries plunged Friday after data showed that the countrys non-farm payroll increased higher than expected in July,reinvigorating expectations of Fed tightening this year. The yield on the benchmark 10-year...

Norwegian manufacturing output falls 1.1 pct in second quarter

Aug 05, 2016 12:47 pm UTC| Commentary Economy

In the second quarter, Norways manufacturing output dropped 1.1 percent seasonally adjusted basis quarter-on-quarter, according to Statistics Norway. Industries that are closely linked to the petroleum industry in...

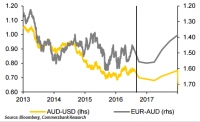

RBA wants currency to weaken; may slash rates if AUD upswings

Aug 05, 2016 12:45 pm UTC| Commentary Central Banks

The Reserve Bank of Australia has taken action in May as well as in August and cut its benchmark rate by 25 basis points each time to a historic low of current 1.5 percent. The central banks move to lower the rate was due...

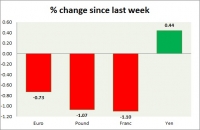

Currency snapshot (major pairs)

Aug 05, 2016 12:43 pm UTC| Commentary

Dollar index trading at 95.74 (+0.22%) Strength meter (today so far) Euro -0.37%, Franc -0.56%, Yen -0.31%, GBP -0.32% Strength meter (since last week) Euro -0.73%, Franc -1.10%, Yen +0.44%, GBP -1.07% EUR/USD...

- Market Data