Dollar index trading at 95.74 (+0.22%)

Strength meter (today so far) – Euro -0.37%, Franc -0.56%, Yen -0.31%, GBP -0.32%

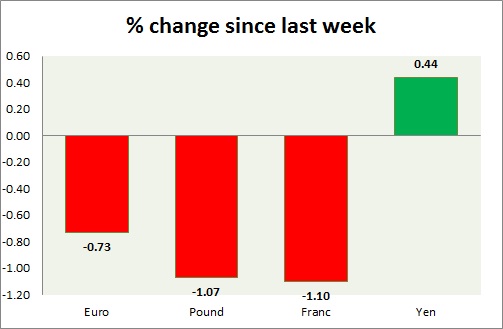

Strength meter (since last week) – Euro -0.73%, Franc -1.10%, Yen +0.44%, GBP -1.07%

EUR/USD –

Trading at 1.11

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support

- Long term – 1.06, Medium term – 1.08, Short term – 1.09

Resistance –

- Long term – 1.16, Medium term – 1.143, Short term – 1.132

Economic release today –

- NIL

Commentary –

- Euro declined as NFP report pushes dollar higher. Active call – Sell EUR/USD at 1.116 with stop loss at 1.15 and target at 1.01

GBP/USD –

Trading at 1.309

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Sell

Support –

- Long term – 1.2, Medium term – 1.27, Short term – 1.29

Resistance –

- Long term – 1.39, Medium term – 1.35, Short term – 1.34

Economic release today –

- UK house prices declined by 1 percent in July.

Commentary –

- Pound remains weak as BoE eased policy and NFP came stronger than expected. We expect the pound to reach parity.

USD/JPY –

Trading at 101.5

Trend meter –

- Long term – Sell, Medium term – Range/ Sell, Short term – Sell

Support –

- Long term – 91, Medium term – 98, Short term – 100

Resistance –

- Long term – 111, Medium term – 107, Short term – 107

Economic release today –

- NIL

Commentary –

- The yen is the best performer of the week. Active call – Buy Yen @119.5 with stop loss around 123.8 and target at 114 and 110, 108.9 and 98.5. All targets reached, new target 90 added. Yen may retrace to 111 per dollar if BOJ intervenes.

USD/CHF –

Trading at 0.979

Trend meter –

- Long term – Buy, Medium term – Range, Short term – Range/Sell

Support –

- Long term – 0.9, Medium term – 0.927, Short term – 0.95

Resistance –

- Long term – 1.037, Medium term – 1.01, Short term – 0.994

Economic release today –

- NIL

Commentary –

- Franc weakened as SNB’s FX reserve indicates higher intervention. We expect Franc to strengthen against Dollar to as high as 0.86 area in the medium term.