Q2 wages in the euro area grow at the weakest pace in six years

Sep 16, 2016 09:59 am UTC| Commentary Economy

Wages in the euro area grew at the weakest pace in almost six years, during the three months ended June, a signal that the common currency zone is struggling the odds of a muted economic recovery, a phase of worry for the...

South-East Australia likely to witness strong recovery in non-mining sector

Sep 16, 2016 09:29 am UTC| Commentary Economy

South-east Australias non-mining business investment seems likely to recover given the worst of the income shock from falling commodity prices looks to be over, while mining capex is likely to be almost back at pre-boom...

UK gilts strengthen as BoE MPC meeting minutes open door for future rate cuts

Sep 16, 2016 09:20 am UTC| Commentary

The UK gilts strengthened Friday as the Bank of England in its monetary policy meeting decided to leave its official bank rate on hold at 0.25 percent and the programme of gilt purchases, financed via reserves issuance,...

Czech Republic’s producer prices fall in August

Sep 16, 2016 09:12 am UTC| Commentary

Czech Republics producer prices remained low in August. On a sequential basis, the countrys industrial producer prices fell 0.2 percent in August, as compared with 0 percent in July. Agricultural producer prices dropped...

German 10-year bund yields again turn negative as Fed Sep rate hike hopes ease

Sep 16, 2016 08:56 am UTC| Commentary

The German 10-year bund yields again turned negative after a week as the United States Federal Reserve September rate hike hopes faded after reading a series of disappointing economic data released Thursday. Investors...

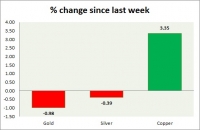

Commodities snapshot (precious & industrial)

Sep 16, 2016 08:53 am UTC| Commentary

Metal pack is mixed today. Performance this week at a glance in chart table - Gold: Gold is going down for another test of $1300 support area. Todays range $1312-1318 We expect gold to reach $1520 Gold is...

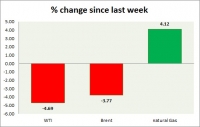

Sep 16, 2016 08:43 am UTC| Commentary

Energy pack is down in todays trading. Weekly performance at a glance in chart table. Oil (WTI) WTI is sliding again after a brief pause yesterday. This week, the benchmark is down around 5 percent. Todays...

- Market Data