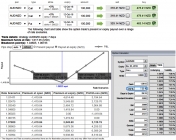

FxWirePro: Maintain bullish outlook for gold

Oct 05, 2016 09:15 am UTC| Commentary

After the rumor hit the market that the European Central Bank (ECB) might go for a tapering after its bond-buying program concludes in April, Gold suffered a very big loss yesterday, probably the biggest single day loss in...

ECB taper rumor rattles markets

Oct 05, 2016 08:39 am UTC| Commentary Economy Central Banks

Yesterday the Eurozone bond market and the bullion got rattled big time on the rumor that the European Central Bank (ECB) might be considering a taper after the bond buying program gets concluded in March. After all, the...

IMF warns on US GDP growth citing election uncertainty

Oct 05, 2016 07:37 am UTC| Commentary Economy

International Monetary Fund (IMF) warned yesterday that the political risks have emerged as the biggest risks to growth while it lowered growth forecast for the UK and the United States. According to the IMF, political...

Indian bonds strengthen as RBI cuts repo rate by 25bps

Oct 05, 2016 07:35 am UTC| Commentary

The Indian government bonds strengthened Wednesday after the Reserve Bank of India lowered its key policy rate by 25 basis points on Tuesday. The yield on the benchmark 10-year bonds, which moves inversely to its price,...

Upturn in Russian service sector moderates slightly in September

Oct 05, 2016 07:17 am UTC| Commentary

The upturn seen in Russias service sector moderated a bit in September as the pace of business activity growth weakened to a four-month low. The headline seasonally adjusted Markit Russia Services Business Activity Index...

Oct 05, 2016 07:16 am UTC| Central Banks Commentary

The AUD has enjoyed support from commodity prices plus the RBA sounding comfortable about Australias outlook as the central bank maintained status quo in its recent monetary policy (cash rates unchanged at 1.50%). An...

JGBs trade mixed in subdued trade; long-term bonds fall on lack of BoJ buying

Oct 05, 2016 07:03 am UTC| Commentary

The Japanese government bonds traded mixed Wednesday, succumbing to thin trading activity during a relatively quiet session that saw little data of much significance. Moreover, super-long bonds fell on lack of BoJ debt...

- Market Data