The AUD has enjoyed support from commodity prices plus the RBA sounding comfortable about Australia’s outlook as the central bank maintained status quo in its recent monetary policy (cash rates unchanged at 1.50%).

An update from the latter on Tue should result in an on-hold decision, markets only assigning a 20% chance of a rate cut.

The main data releases for rest of the week will be the international trade (Thu).

The pair is trading well above fair value implied by relative interest rates, commodities, and risk sentiment and needs to correct this deviation eventually.

In addition, the RBNZ has signaled further easing while the RBA has not signalled anything.

Hence, we advocated hedging AUDNZD’s bullish risks via options straps as expectations of RBNZ’s OCR cut intensify.

As early as March the central bank had cut rates due to the strong NZD. And only last month it pointed out that the kiwi is still trading approx. 6% stronger on a trade-weighted basis than it had assumed in its projections. Based on these projections the RBNZ even expects NZD to depreciate by an impressive 8% by year end.

OTC updates and Options Strategy:

As a result of the above monetary policy events, the Australian dollar has been gaining against the kiwi dollar, with AUDNZD edging up higher at 1.0606, given a key resistance is broken at 1.0623 levels, further upside moves can’t be ruled out.

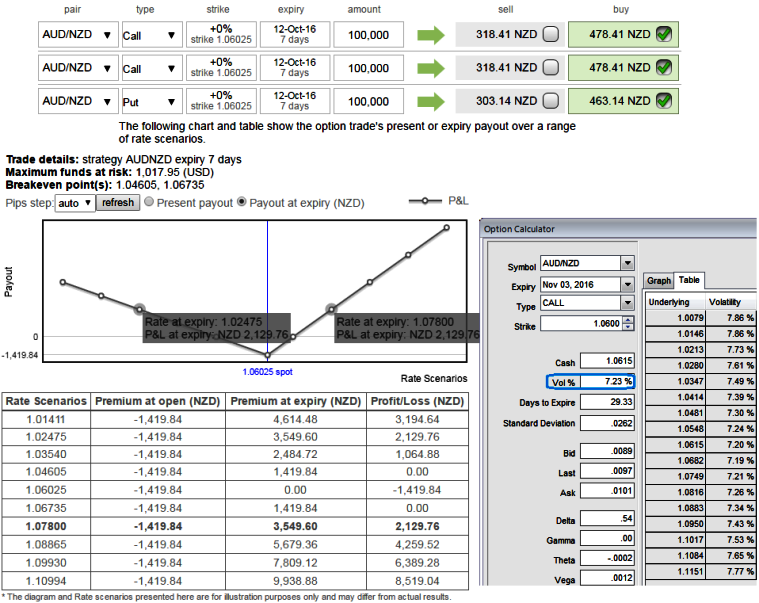

Well, in order to arrest this upside risk, we recommend option strap strategy that favours underlying spot’s upside bais.

1W at the money volatilities of 50% delta calls and puts are exorbitantly priced in as the ATM IVs are just shy above 7.2% that are not favorable to the option holders as you can see IVs and corresponding movements in vega but still considering above fundamental developments and payoff structure of the strategy, below positions are recommended on hedging grounds.

We recommend building the FX portfolio exposed to this pair with longs positions in 2 lots of 2W ATM 0.51 delta calls and 1 lot of ATM -0.49 delta puts of the same expiries.

The strategy is likely to derive handsome returns on the upside and certain yields regardless of swings on either side as shown in the diagram.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist