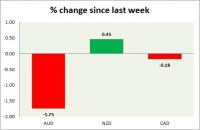

Currency snapshot (commodity pairs)

May 09, 2017 11:01 am UTC| Commentary

Dollar index trading at 99.42 (+0.26%) Strength meter (today so far) Aussie -0.52%, Kiwi -0.42%, Loonie +0.13% Strength meter (since last week) Aussie -1.75%, Kiwi +0.45%, Loonie -0.18% AUD/USD Trading at...

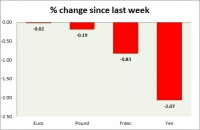

Currency snapshot (major pairs)

May 09, 2017 10:55 am UTC| Commentary

Dollar index trading at 99.4 (+0.24%) Strength meter (today so far) Euro -0.35%, Franc -0.48%, Yen -0.54%, GBP -0.15% Strength meter (since last week) Euro -0.02%, Franc -0.83%, Yen -2.07%, GBP -0.19% EUR/USD...

Fundamentals to watch out for this week

May 09, 2017 10:29 am UTC| Commentary Economy

This week is relatively less risk-heavy in terms of scheduled data and events. What to watch for over the coming days: Central Banks: Several Federal Reserve policymakers are scheduled to speak this week;...

UK gilts continue to slump ahead of BoE’s monetary policy meeting, March manufacturing production

May 09, 2017 10:00 am UTC| Commentary Economy

The UK gilts continued to plunge Tuesday as investors wait to watch the Bank of Englands (BoE) monetary policy meeting, scheduled to be held on May 11. Also, the countrys manufacturing production for the month of March,...

Latest Commitment of Traders positions (FX) as at May 2nd 2017

May 09, 2017 09:32 am UTC| Commentary

CFTC commitment of traders report was released on Friday (5th May) and cover positions up to Tuesday (2nd May). COT report is not a complete presenter of entire market positions since the future market is relatively...

Latest Commitment of Traders positions (Commodities) as of May 2nd 2017

May 09, 2017 09:22 am UTC| Commentary

CFTC commitment of traders report was released on Friday (5th May) and cover positions up to Tuesday (2nd May). COT report is not a complete presenter of entire market positions; however, it represents a good chunk of...

Latest Commitment of Traders positions (Equities and Bonds) as at May 2nd 2017

May 09, 2017 09:15 am UTC| Commentary

CFTC commitment of traders report was released on Friday (5th May) and cover positions up to Tuesday (2nd May). COT report is not a complete presenter of entire market positions; however, it represents a good chunk of...

- Market Data