Dollar index trading at 99.4 (+0.24%)

Strength meter (today so far) – Euro -0.35%, Franc -0.48%, Yen -0.54%, GBP -0.15%

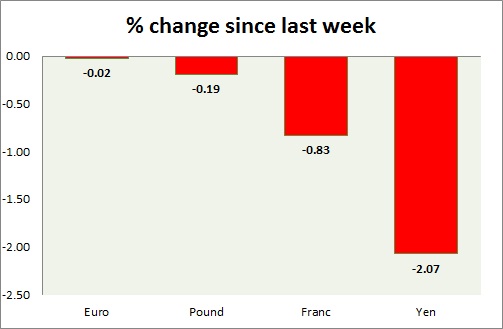

Strength meter (since last week) – Euro -0.02%, Franc -0.83%, Yen -2.07%, GBP -0.19%

EUR/USD –

Trading at 1.089

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Range

Support

- Long term – 1.032, Medium term – 1.05, Short term – 1.07

Resistance –

- Long term – 1.12, Medium term – 1.10, Short term – 1.10

Economic release today –

- NIL

Commentary –

- The euro failed to gain on risk-on rally despite Macron win.

GBP/USD –

Trading at 1.292

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 1.16, Medium term – 1.23, Short term – 1.27

Resistance –

- Long term – 1.32, Medium term – 1.305, Short term – 1.305

Economic release today –

- NIL

Commentary –

- The pound continues to hover around key 1.3 level. We expect the pound to reach parity in the longer run.

USD/JPY –

Trading at 113.8

Trend meter –

- Long term – Sell, Medium term – sell, Short term – Range

Support –

- Long term – 107, Medium term – 107, Short term – 107

Resistance –

- Long term – 119, Medium term – 115, Short term – 112

Economic release today –

- Labor cash earnings declined 0.4 percent y/y in March.

Commentary –

- The yen is the worst performer of the week so far due to risk affinity.

USD/CHF –

Trading at 1.002

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Range

Support –

- Long term – 0.95, Medium term – 0.95, Short term – 0.98

Resistance –

- Long term – 1.08, Medium term – 1.037, Short term – 1.037

Economic release today –

- Unemployment rate for April at 3.3 percent.

Commentary –

- Franc is back below parity once again. Active call -Franc might decline to 1.08 per dollar. Target extended to 1.14

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX