May 31, 2019 10:15 am UTC| Commentary Central Banks Economy

The Reserve Bank of Australia (RBA) is expected to adopt a rate cut at its upcoming monetary policy meeting scheduled to be held next week, according to the latest report from ANZ Research. The market will be shocked if...

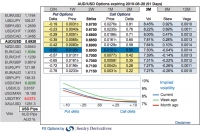

FxWirePro: Options Strategies to Trade and Hedge Antipodeans Ahead of RBA

May 31, 2019 09:17 am UTC| Research & Analysis Central Banks

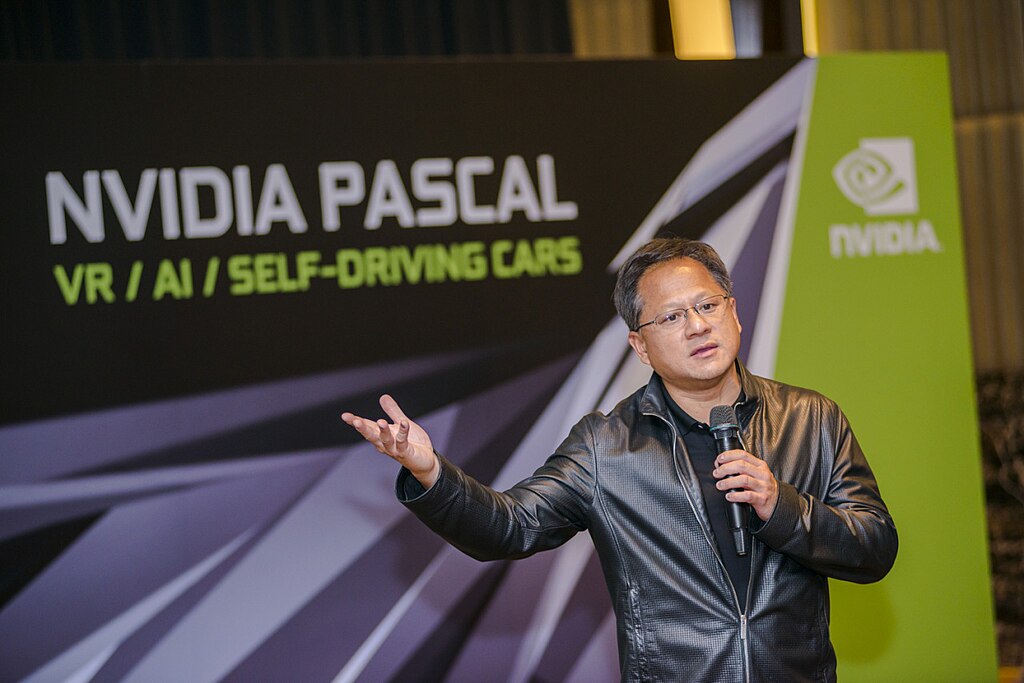

The major driving forces of the pair, at this juncture, are RBA vs RBNZ rate outlooks, and the US-China trade relations. The near-term gyrations in the latter are unpredictable. RBA is scheduled for their monetary policy...

May 31, 2019 06:55 am UTC| Commentary Central Banks Economy

The Reserve Bank of India (RBI) is expected to use the current low rate of headline inflation as justification for a third consecutive rate cut at the conclusion of its policy meeting on Thursday, June 6, according to the...

FxWirePro: Deploy ‘debit call spreads’ to hedge USD/RUB

May 30, 2019 13:31 pm UTC| Research & Analysis Central Banks

We remain MW RUB in the GBI-EM Model portfolio, but are bearishly biased, holding USDRUB call spreads. YTD the ruble has been the strongest performer in EM FX, with a spot around +7.2% stronger against USD. However, in...

May 29, 2019 17:32 pm UTC| Commentary Central Banks

The Bank of Canada stood pat today, keeping its overnight interest rate at 1.75 percent. The central banks statement came with the decision had a business as usual tone, implying that there continues to be impetus to move...

Bank of Canada monetary policy preview

May 29, 2019 12:16 pm UTC| Commentary Central Banks

Today, the Bank of Canada (BoC) is to provide further guidance in policy meet. The result of the monetary policy meeting is scheduled to be announced at 14:00 GMT. No press conference scheduled today. Current policy...

May 29, 2019 10:24 am UTC| Research & Analysis Central Banks

Bearish AUDUSD scenarios below 0.69 if: 1) the RBA cuts rates more quickly than we expect; 2) the Fed responds to firm labor market outcomes by reinvigorating the 2019 rate guidance; 3) the Financial conditions in...

- Market Data