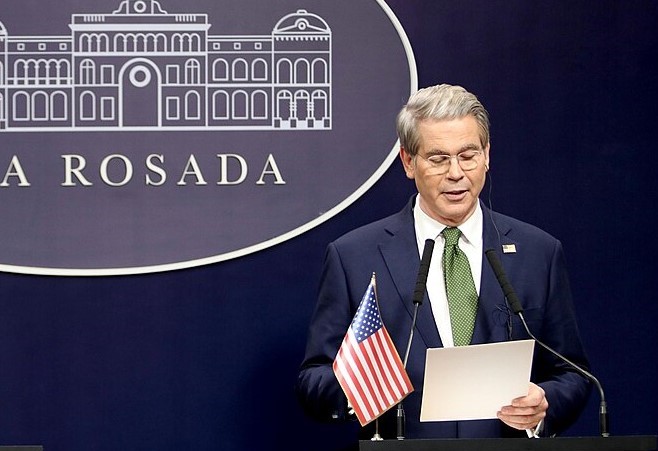

U.S. Treasury Secretary Scott Bessent announced Thursday that the Biden-era global tax framework will be modified under a new G7 agreement, prompting the removal of the controversial Section 899 tax proposal from the Republican tax and spending bill.

Section 899, introduced by GOP lawmakers, would have allowed President Donald Trump to impose retaliatory taxes on countries targeting U.S. firms under the 2021 OECD global tax deal. However, Bessent confirmed that the agreement with the Group of Seven nations shields American companies from the 15% global minimum tax under “Pillar 2” of the OECD-G20 Inclusive Framework.

“After months of productive dialogue, the U.S. and G7 have reached a joint understanding that protects American interests,” Bessent posted on X. He added that the countries would cooperate on implementing the new deal in the coming months.

This move potentially paves the way for Trump to fulfill his pledge to withdraw the U.S. from the OECD tax agreement while minimizing international fallout. The revised deal appears to address key concerns from U.S. corporations and Republicans, particularly around digital services taxes and global reallocation of taxing rights.

Bessent’s statement followed news that GOP lawmakers, facing internal opposition and pressure from the business community, were considering scrapping Section 899. The updated tax legislation is now expected to move forward, with final votes possibly taking place as early as Saturday, ahead of the July 4 holiday.

“This G7 consensus promotes economic stability and encourages investment in the U.S. and worldwide,” Bessent said.

The new deal marks a significant shift in U.S. tax policy, easing tensions with allies while aligning with Trump’s pro-growth, pro-business agenda as he pushes to finalize the tax bill swiftly.

RFK Jr. Overhauls Federal Autism Panel, Sparking Medical Community Backlash

RFK Jr. Overhauls Federal Autism Panel, Sparking Medical Community Backlash  Kevin Warsh’s Fed Nomination Raises Questions Over Corporate Ties and U.S.–South Korea Trade Tensions

Kevin Warsh’s Fed Nomination Raises Questions Over Corporate Ties and U.S.–South Korea Trade Tensions  China Approves First Import Batch of Nvidia H200 AI Chips Amid Strategic Shift

China Approves First Import Batch of Nvidia H200 AI Chips Amid Strategic Shift  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Gold Prices Stabilize in Asian Trade After Sharp Weekly Losses Amid Fed Uncertainty

Gold Prices Stabilize in Asian Trade After Sharp Weekly Losses Amid Fed Uncertainty  Trump Says Fed Pick Kevin Warsh Could Win Democratic Support in Senate Confirmation

Trump Says Fed Pick Kevin Warsh Could Win Democratic Support in Senate Confirmation  Putin Envoy Kirill Dmitriev to Visit Miami for Talks With Trump Administration Officials

Putin Envoy Kirill Dmitriev to Visit Miami for Talks With Trump Administration Officials  Russia Stocks End Flat as MOEX Closes Unchanged Amid Mixed Global Signals

Russia Stocks End Flat as MOEX Closes Unchanged Amid Mixed Global Signals  Faith Leaders Arrested on Capitol Hill During Protest Against Trump Immigration Policies and ICE Funding

Faith Leaders Arrested on Capitol Hill During Protest Against Trump Immigration Policies and ICE Funding  Trump Threatens 50% Tariff on Canadian Aircraft Amid Escalating U.S.-Canada Trade Dispute

Trump Threatens 50% Tariff on Canadian Aircraft Amid Escalating U.S.-Canada Trade Dispute  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  U.S. Government Enters Brief Shutdown as Congress Delays Funding Deal

U.S. Government Enters Brief Shutdown as Congress Delays Funding Deal  India Budget 2025 Highlights Manufacturing Push but Falls Short of Market Expectations

India Budget 2025 Highlights Manufacturing Push but Falls Short of Market Expectations  China Manufacturing PMI Slips Into Contraction in January as Weak Demand Pressures Economy

China Manufacturing PMI Slips Into Contraction in January as Weak Demand Pressures Economy  Asian Stocks Waver as Trump Signals Fed Pick, Shutdown Deal and Tech Earnings Stir Markets

Asian Stocks Waver as Trump Signals Fed Pick, Shutdown Deal and Tech Earnings Stir Markets  UK Employers Plan Moderate Pay Rises as Inflation Pressures Ease but Persist

UK Employers Plan Moderate Pay Rises as Inflation Pressures Ease but Persist  South Korea Factory Activity Hits 18-Month High as Export Demand Surges

South Korea Factory Activity Hits 18-Month High as Export Demand Surges