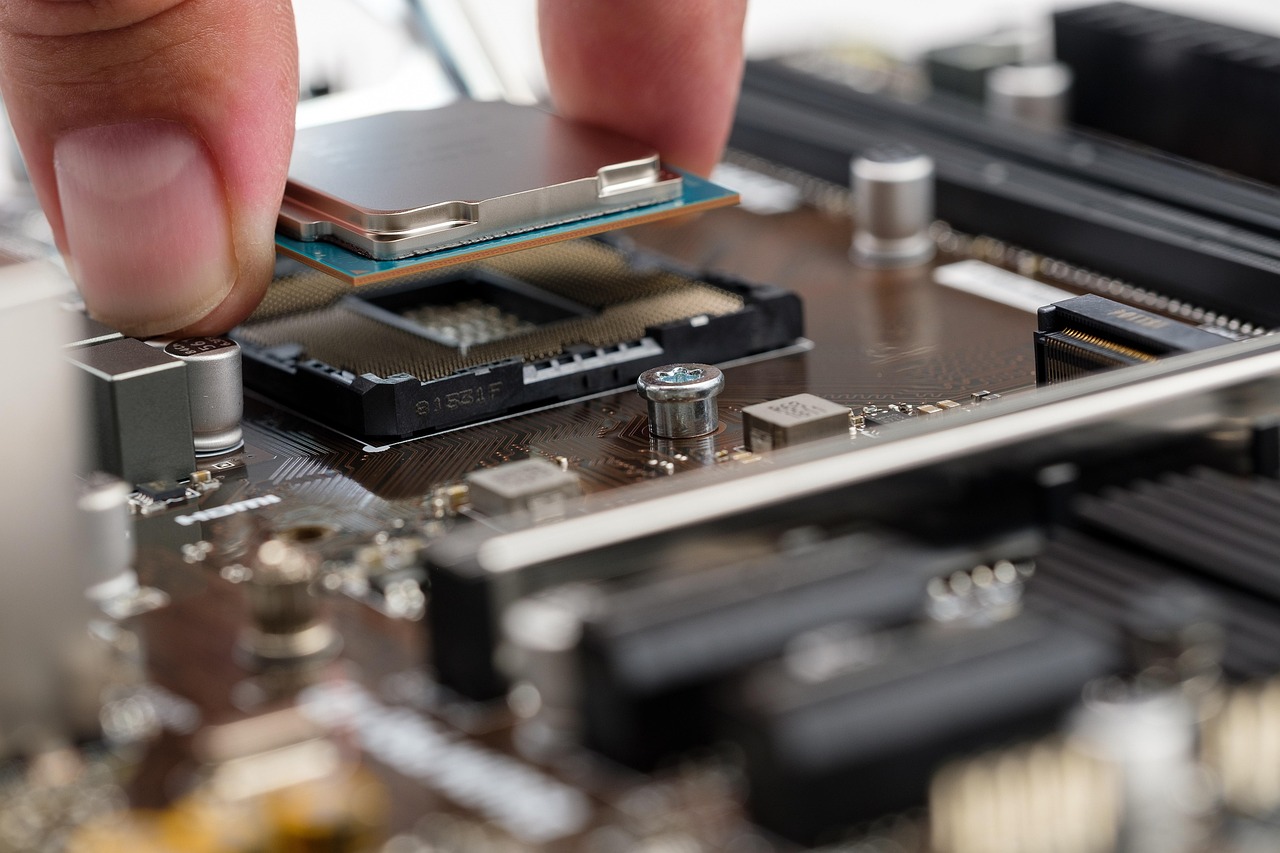

U.S. chip stocks dropped Monday following reports that the Trump administration is planning stricter controls on China’s tech sector. The proposed rule would expand current sanctions to include subsidiaries of blacklisted companies, closing a loophole that has allowed Chinese firms to bypass restrictions by creating new corporate entities.

According to Bloomberg, the rule would require U.S. government licenses for transactions involving any firm that is at least 50% owned by a company already on the U.S. Entity List, Military End-User list, or the Specially Designated Nationals list. The regulation, still under discussion, could be introduced as early as June and may pave the way for further sanctions against Chinese tech giants.

The move comes amid rising U.S.-China tensions, especially in the semiconductor sector. On Friday, President Donald Trump accused Beijing of undermining recent Geneva trade negotiations. In response, China expressed frustration over U.S. chip export controls, while the U.S. criticized China’s restrictions on critical minerals.

Markets reacted swiftly. Nvidia (NASDAQ: NVDA) fell 1%, Marvell Technology (NASDAQ: MRVL) dropped 1.9%, and Broadcom (NASDAQ: AVGO) declined 0.9%. Taiwan Semiconductor Manufacturing Co. (TSMC) slipped 0.9%, and the iShares Semiconductor ETF (NASDAQ: SOXX) was down nearly 1% in premarket trading. Chinese chipmakers were also hit, with SMIC down 1.1% and Hua Hong Semiconductor losing nearly 3% in Hong Kong.

This policy shift underscores Washington’s intent to curb China’s tech rise by targeting not only parent companies but also their global subsidiaries. U.S. officials have described the regulatory gap as a game of “whack-a-mole,” emphasizing the need for tighter enforcement to prevent circumvention of existing sanctions.

Syria-Kurdish Ceasefire Marks Historic Step Toward National Unity

Syria-Kurdish Ceasefire Marks Historic Step Toward National Unity  U.S. Government Enters Brief Shutdown as Congress Delays Funding Deal

U.S. Government Enters Brief Shutdown as Congress Delays Funding Deal  CSPC Pharma and AstraZeneca Forge Multibillion-Dollar Partnership to Develop Long-Acting Peptide Drugs

CSPC Pharma and AstraZeneca Forge Multibillion-Dollar Partnership to Develop Long-Acting Peptide Drugs  Trump Pushes Back on 401(k) Homebuyer Plan Amid Housing Affordability Debate

Trump Pushes Back on 401(k) Homebuyer Plan Amid Housing Affordability Debate  ICE Blocked From Entering Ecuador Consulate in Minneapolis During Immigration Operation

ICE Blocked From Entering Ecuador Consulate in Minneapolis During Immigration Operation  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Rafah Border Crossing to Reopen for Palestinians as Israel Coordinates with Egypt and EU

Rafah Border Crossing to Reopen for Palestinians as Israel Coordinates with Egypt and EU  Nvidia’s $100 Billion OpenAI Investment Faces Internal Doubts, Report Says

Nvidia’s $100 Billion OpenAI Investment Faces Internal Doubts, Report Says  FCC Chairman Raises Competition Concerns Over Netflix–Warner Bros. Discovery Deal

FCC Chairman Raises Competition Concerns Over Netflix–Warner Bros. Discovery Deal  Trump Says Fed Pick Kevin Warsh Could Win Democratic Support in Senate Confirmation

Trump Says Fed Pick Kevin Warsh Could Win Democratic Support in Senate Confirmation  South Korea Repatriates 73 Suspected Online Scammers From Cambodia in Major Crackdown

South Korea Repatriates 73 Suspected Online Scammers From Cambodia in Major Crackdown  Panama Supreme Court Voids Hong Kong Firm’s Panama Canal Port Contracts Over Constitutional Violations

Panama Supreme Court Voids Hong Kong Firm’s Panama Canal Port Contracts Over Constitutional Violations  SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers

SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers  Boeing Secures New Labor Contract With Former Spirit AeroSystems Employees

Boeing Secures New Labor Contract With Former Spirit AeroSystems Employees  More Than 100 Venezuelan Political Prisoners Released Amid Ongoing Human Rights Scrutiny

More Than 100 Venezuelan Political Prisoners Released Amid Ongoing Human Rights Scrutiny  OpenAI Reportedly Eyes Late-2026 IPO Amid Rising Competition and Massive Funding Needs

OpenAI Reportedly Eyes Late-2026 IPO Amid Rising Competition and Massive Funding Needs