The Reserve Bank of New Zealand (RBNZ) may actually need to cut benchmark interest rates in order for NZGBs to further outperform their global peers from current levels, according to the latest report from ANZ Research.

New Zealand’s 10-year government bond yield has decoupled from the US, with the relative outlooks for monetary policy explaining most, but not all, of that divergence. It is a similar story when comparing New Zealand’s 10-year yield with a broader measure of the ‘world’ interest rate (estimated using principal components).

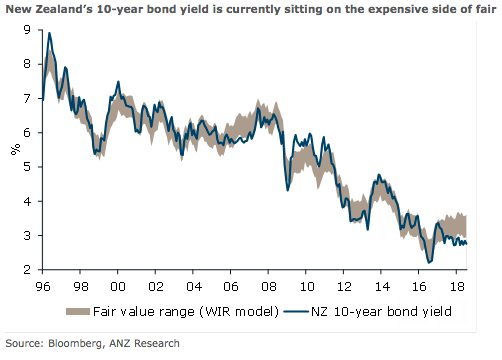

New Zealand bonds are starting to look a touch expensive. A solid local fiscal situation, improved external debt metrics and low global volatility perhaps help explain this outperformance (on top of domestic monetary policy of course), the report added.

The Government’s underlying fiscal balance is currently in surplus to the tune of 2 percent of GDP. This is the largest surplus since 2008 and the Government is projecting it to roughly hold around this level over the next four years.

"While we only have history back to 2009, we estimate that New Zealand’s sovereign CDS spread, at around 18bps, is sitting around the 5th percentile currently, implying the market sees very low default risk,” the report also commented.

New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026

New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026  EU Recovery Fund Faces Bottlenecks Despite Driving Digital and Green Projects

EU Recovery Fund Faces Bottlenecks Despite Driving Digital and Green Projects  Gold Prices Stabilize in Asian Trade After Sharp Weekly Losses Amid Fed Uncertainty

Gold Prices Stabilize in Asian Trade After Sharp Weekly Losses Amid Fed Uncertainty  Oil Prices Slide Nearly 3% as U.S.-Iran Talks Ease Geopolitical Tensions

Oil Prices Slide Nearly 3% as U.S.-Iran Talks Ease Geopolitical Tensions  China Home Prices Rise in January as Government Signals Stronger Support for Property Market

China Home Prices Rise in January as Government Signals Stronger Support for Property Market  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Asian Markets Slide as Silver Volatility, Earnings Season, and Central Bank Meetings Rattle Investors

Asian Markets Slide as Silver Volatility, Earnings Season, and Central Bank Meetings Rattle Investors  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks