Hungary’s central bank left its benchmark interest rate at a record low of 0.9 percent for a fifth month in October and signaled that the easing cycle is finished for now. The central bank, which targets 3 percent price growth in the medium term, said at its October meeting that it still saw the inflation environment as “subdued.”

Hungary's inflation rose more-than-expected to hit a 3-year high in October, data released by the Hungarian Central Statistical Office showed on Tuesday. Inflation rose to 1 percent in October from 0.6 percent in September, beating forecasts for a rise of 0.8 percent. This was the highest since September 2013, when prices advanced 1.4 percent. MNB in October lowered its inflation projections for 2016, but forecasts core inflation to accelerate to 2.9 percent in 2017.

"In our view, however, CEE core inflation does not show any real sign of turning around. All signs of acceleration are limited to the influence of energy price base effect on year-on-year rates of change. Mild acceleration in such year-on-year rates is unlikely to lead to sustainable inflation acceleration back to target," notes Commerzbank in a report.

Moody's upgraded Hungary's debt into investment grade late on Friday. Fitch did this first in May, S&P surprisingly upgraded in September. The forint has firmed in the past months due to Hungary's improving economic fundamentals and ratings upgrades. Money managers will likely be increasing their portfolio exposure to Hungarian assets, which would be further HUF-supportive in the near-term.

Hungarian central bank (NHB) Governor Gyorgy Matolcsy told in an interview today that the central bank could keep its main base rate at 0.9 percent in the long term even if major central banks start hiking interest rates. Matolcsy said the bank, which has provided cheap funding was not planning a similar loan programme in the second half of his six-year term. Separately, the bank said on its website that underlying indicators still pointed to low inflation pressures.

"We have set ourselves for a base rate level which can work in the long term, which can be maintained even if the Fed carries out a new rate hike cycle in several steps and if potentially the ECB and the Japanese central bank respond to that," Matolcsy said.

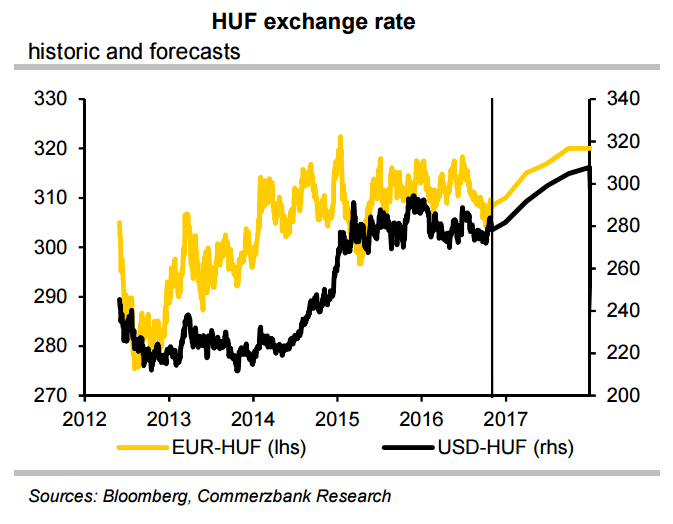

EUR/HUF edged lower from day's highs around 306.25 to trade at 305.70 at around 12:15 GMT. Intraday bias for the pair remained lower. 5-DMA at 306.46 was immediate resistance on the upside, while downside finds little support till 303.32 (Oct 7 lows).

New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026

New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026  China Services PMI Hits Three-Month High as New Orders and Hiring Improve

China Services PMI Hits Three-Month High as New Orders and Hiring Improve  U.S. Stock Futures Edge Lower as Tech and AI Stocks Drag Wall Street Ahead of Key Earnings

U.S. Stock Futures Edge Lower as Tech and AI Stocks Drag Wall Street Ahead of Key Earnings  Indian Rupee Strengthens Sharply After U.S.-India Trade Deal Announcement

Indian Rupee Strengthens Sharply After U.S.-India Trade Deal Announcement  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Japan Finance Minister Defends PM Takaichi’s Remarks on Weak Yen Benefits

Japan Finance Minister Defends PM Takaichi’s Remarks on Weak Yen Benefits  Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure

Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure  China and Uruguay Strengthen Strategic Partnership Amid Shifting Global Order

China and Uruguay Strengthen Strategic Partnership Amid Shifting Global Order  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Australia’s Corporate Regulator Urges Pension Funds to Boost Technology Investment as Industry Grows

Australia’s Corporate Regulator Urges Pension Funds to Boost Technology Investment as Industry Grows  Australian Scandium Project Backed by Richard Friedland Poised to Support U.S. Critical Minerals Stockpile

Australian Scandium Project Backed by Richard Friedland Poised to Support U.S. Critical Minerals Stockpile