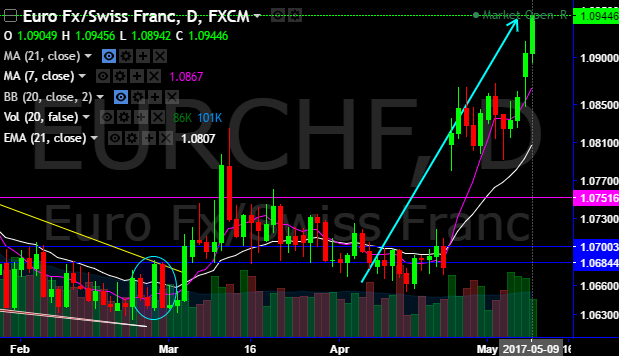

The victory of moderate candidate Emmanuel Macron in the French presidential election has allowed the Swiss franc to depreciate significantly against the euro. This reduces the SNB’s need to intervene. While we still believe the CHF will generally remain under appreciation pressure, levels around 1.09 in EURCHF should be sustained for the time being. However, we expect falling exchange rates again by the end of the year at the latest. The Swiss franc has suffered substantial losses versus the euro since the presidential election in France (refer above chart).

The Swiss National Bank (SNB) should be overjoyed: At EURCHF levels well above 1.08, there is no longer any reason for it to intervene in the FX market to prevent a stronger franc. We, as renowned CHF bulls, also believe current EURCHF levels should actually be sustained. In the short term, there are two factors supporting higher EURCHF levels: (1) the ECB’s monetary policy and (2) brighter risk sentiment with regard to the stability of the eurozone. However, both factors are likely to turn again by the end of the year at the latest.

Options Strategic framework (Long CHF - call spread versus USD; hold vs EUR in spot):

The sell-off in USDCHF was too little, too late for our put spread that expired OTM. We continue to hold a short position in EURCHF as we do not believe that the French election will be a game-changer for EURCHF insofar as it will do little to resolve the powerful balance of payments disequilibrium in favor of CHF. That being said, we are close to our stop and would step aside for a period should this be triggered.

We await Monday's sight deposit data to gauge whether or not the SNB has continued to intervene even in the face of a stronger EUR. As an aside, we find it interesting that the SNB appeared to actively sell EUR FX reserves in 1Q in favor of USD and JPY, thereby undermining the objective of its intervention assuming this is to stabilize EURCHF (SNB probably sold EUR in 1Q17).

In all we are comfortable with the existing cash position in EURCHF, albeit the strikes on the USDCHF have proved frustratingly elusive as expiry looms next week.

Hold a 2m 1.0010 - 0.95 USDCHF debit put spread.

Stay short EURCHF in cash although you have seen sharp spikes that seem momentary, we are expecting the considerable pullback from bearish rallies. Marked at -1.23%.

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook

ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Bank of Japan Likely to Delay Rate Hike Until July as Economists Eye 1% by September

Bank of Japan Likely to Delay Rate Hike Until July as Economists Eye 1% by September  China Holds Loan Prime Rates Steady in January as Market Expectations Align

China Holds Loan Prime Rates Steady in January as Market Expectations Align  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure

Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing

Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing