The Bank of England is expected to announce an increase in interest rates for the first time in more than a decade, moving the Bank Rate up a quarter point to 0.5%. The recent shift in tone among policymakers partly reflects the ongoing resilience of the economy. Further, the increase in the urgency around a rate hike has been aided by the recent resumption of the inflation uptrend and by signs of an increasingly tight labor market, which has raised concerns that the UK is potentially facing capacity constraints.

There is a large degree of uncertainty on the vote split. The median consensus is 6-3 in favor of a rate rise, according to a Bloomberg survey. The central view is 8-1, with Jon Cunliffe potentially voting for unchanged policy.

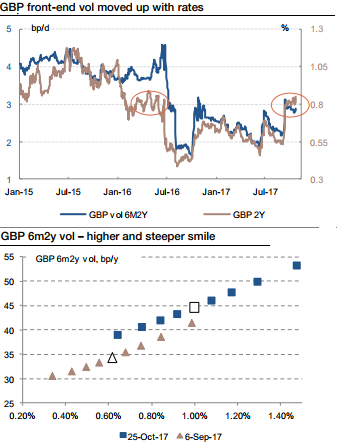

Either 1x2 receiver spread or 6m2y receiver fly Buy GBP 1x2 receiver spread ATMF+10bp/ATMF-6bp – zero-cost (indicative). Indicative GBP 6m2y fwd 0.99%, spot 0.85%. At expiry, the strategy generates the maximum profit of 16bp if the GBP 2y rate is roughly 10bp above the current levels (and 6bp below the current 6m2y forward). If rates increase more than 10bp above the 6m2y forward, the PL is zero. For those averse to the risk of unlimited losses Buy GBP 6m2y receiver fly ATMF- 15bp/ATMF/ATMF+15bp – for 3bp running (indicative). The maximum payout of 15bp is realized at expiry if the 2y rate converges to its 6m2y forward. The maximum payout is 5 times bigger than the premium paid (15:3).

The front end is priced for a hike A stronger than expected 3Q GDP reading sets the scene for a BoE rate hike at its meeting on 2 November. The MPC dated SONIAs are already 90% priced for this outcome meaning the front end of the curve will not re-price but should continue to trade as if the next move is a hike. Over the next six months or so, current forwards at the front end of the GBP swap curve are expected to realize.

History suggests that the back-up in GBP 2y swap rates comes ahead of the first hike and that there is some stability thereafter. The swaption market allows expressing this view in a leveraged way, benefiting from the recent spike in GBP short rates vol (refer above graph) and from the steep smile (refer above graph). Both of these trades deliver maximum profits if the 2y rate is around (but below) its 6m forward rate in 6m time. Courtesy: SG

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  OCBC Raises Gold Price Forecast to $5,600 as Structural Demand and Uncertainty Persist

OCBC Raises Gold Price Forecast to $5,600 as Structural Demand and Uncertainty Persist  Japan Declines Comment on BOJ’s Absence From Global Support Statement for Fed Chair Powell. Source: Asturio Cantabrio, CC BY-SA 4.0, via Wikimedia Commons

Japan Declines Comment on BOJ’s Absence From Global Support Statement for Fed Chair Powell. Source: Asturio Cantabrio, CC BY-SA 4.0, via Wikimedia Commons  ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook

ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026

New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Morgan Stanley Raises KOSPI Target to 5,200 on Strong Earnings and Reform Momentum

Morgan Stanley Raises KOSPI Target to 5,200 on Strong Earnings and Reform Momentum