In today's NBP meeting, just like the NBR, has been a status quo event. There had been some likelihood earlier that the Polish central bank might change its rhetoric or assessment because inflation was beginning to accelerate and rising energy prices, globally, were a risk factor.

The National Bank of Poland held its benchmark reference rate at a record low of 1.5 percent on October 3rd2018, as widely anticipated. We already observed euro zone inflation surprise to the downside for September and this week, Polish inflation did so too – the headline inflation rate dipped back from 2% to 1.8%, and calculations suggest that the core inflation rate dipped too. With underlying inflation running only at c.1.4% at the moment (CB inflation target: 2.5%), we do not see any reason why NBP would change its stance or assessment today.

We like the following expressions of short EM and/or high- beta G10 FX vol:

OTM EURPLN calls: Our EMEA team has a constructive take on the zloty, which is a first order source of comfort for vol sellers. Exposure to a slow burn recovery in the Euro area, strong domestic dataflow that has anchored growth forecasts at an impressive 3.8% pace for 2H’18 and revival of FDI inflows are FX positives that should promote PLN outperformance vis-à-vis regional EM peers.

On the vol side of things, EURPLN risk-reversals have been elevated for a while (SABR implied spot-vol corr for 3M riskies 42%), but it is only in the past couple of weeks that realized spot-vol corrs have plummeted (10-day spot-3M ATM vol corr. -20%) and created genuine value in shorting OTM EUR calls on the surface. This is better done in shorter rather than longer maturities given the flatness of the vol curve.

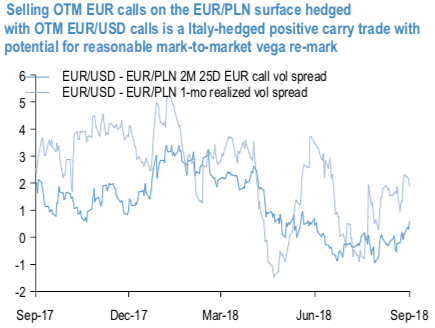

For instance, 2M 25D EUR calls at 6.3 vol are priced at a 1.5 vol premium to trailing 1m realized vol.

Taking advantage of this richness via short EURPLN – long EURUSD option spreads using OTM EUR calls. The rationale is two-fold:

a) Neutralization of Italian budget risks inherent in selling EUR-cross options; and

b) The long vol hedge is efficient on a standalone basis and does not detract from core short vol P/L: in contrast to the EURPLN surface, OTM EUR calls are priced at a discount on the EURUSD surface, and gamma is much firmer. The net result is a positive carry vol spread construct that has decent potential for mark-to-market gains from a re-pricing of implied vols (refer above chart). Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index has shown -94 (which is bearish), while hourly USD spot index has shown 97 (bullish), while articulating at 13:25 GMT.

For more details on the index, please refer below weblink:

Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure

Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  U.S. Prosecutors Investigate Fed Chair Jerome Powell Over Headquarters Renovation

U.S. Prosecutors Investigate Fed Chair Jerome Powell Over Headquarters Renovation  Japan Declines Comment on BOJ’s Absence From Global Support Statement for Fed Chair Powell. Source: Asturio Cantabrio, CC BY-SA 4.0, via Wikimedia Commons

Japan Declines Comment on BOJ’s Absence From Global Support Statement for Fed Chair Powell. Source: Asturio Cantabrio, CC BY-SA 4.0, via Wikimedia Commons  U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns

U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks