After a bout of volatility early in the day following publication of inflation data, the lira consolidated its recent gains and ended on a strong note. We view this as a result of improved EM risk sentiment as the USD has weakened through January in contrast to what had been feared by markets.

Turkey's own January data confirmed that inflation had entered an upswing driven by rising oil prices and lira depreciation. That said, the extreme January surprise can be explained by food and transport prices; core inflation accelerated only mildly, which given ample warnings by CBT, that inflation was set to move higher in the near-term, did not particularly alarm markets.

Such trends can only last for as long as the USD remains benign, though. For the time being, the Trump administration's verbal intervention against USD strength has nicely bailed out the lira, but we expect pressure to pick up again in coming months.

The CBRT hiked only the upper band of the corridor but vowed to do more if needed.

The CBRT hiked only the ceiling of its interest rate corridor this week, leaving the floor and the policy rate unchanged. Not surprisingly, the interest rate announcement was more hawkish than after previous meetings.

The Central Bank of Turkey held its benchmark one-week repo rate at 8 pct on January 24th, while markets were expecting a 50bps hike, and raised its lending rate by 75bps to 9.25 pct, in an attempt to support the currency and to contain deterioration in the inflation outlook.

Importantly, the CBRT underlined its inflation concerns and discussed delivering further monetary tightening if and when needed, vowing to use its liquidity tools to prevent (in CBRT’s words) unhealthy price behavior.

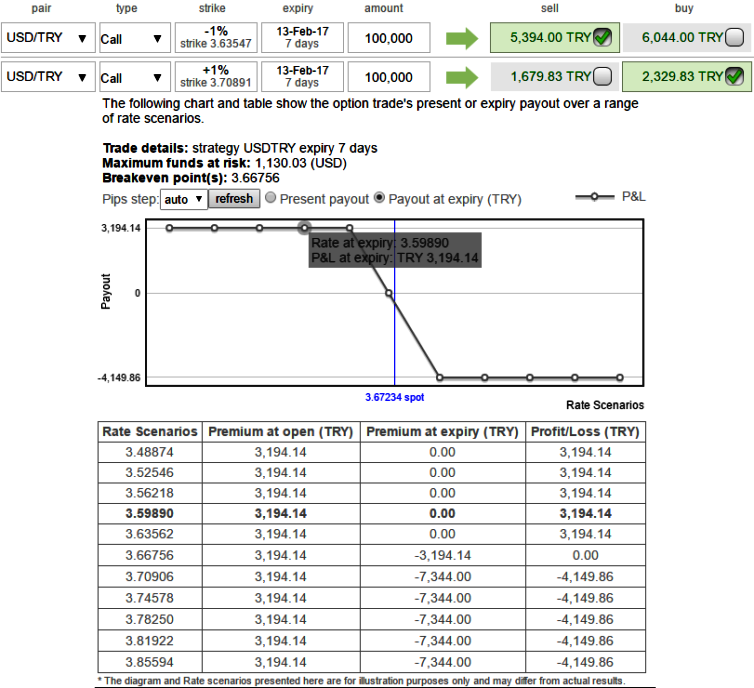

For now, contemplating more bullish rout on the table in medium run amid short-term slumps in USDTRY, we advocate 1w USDTRY 1x1 diagonal credit call spread with conviction (3.6354, 3.7089), spot ref: 3.6724, as shown in the diagram the positions could be entered at the net credit.

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close