Canadian central bank (BoC) is scheduled for their monetary policy on September 4th. A resurgence of global fears from weak cyclicals and renewed trade war risk reversed most of CAD’s second-quarter strength against the dollar. USDCAD has rebounded 2.5% from mid-July lows of just above 1.30 back above 1.33, on the back of broad dollar strength as global trade war risks re-intensified and global recession fears rose.

However, what has not reversed yet is CAD’s ongoing outperformance against all its G10 high-beta and most EM peers (refer 1st chart).

The drivers of this outperformance will likely fade in the coming months. FX outperformance in recent months has been consistent with unexpectedly strong growth, with our economist having raised its 2Q GDP tracking to 3.2%, SAAR. But we continue to view this strength as being temporary. Certainly, the rebound in activity in Alberta on account of easing of oil production curbs will normalize, especially given the softer tone in global oil prices.

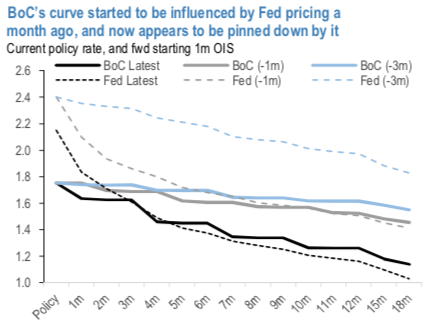

The BoC's reaction function, especially relative to the Fed, will remain one of the biggest uncertainties around CAD’s relative performance. CAD 2y OIS has declined 11bps in the past month, and now is pricing in up to three cuts by end-2020, starting in December.

Few economists are forecasting the BoC to deliver insurance cuts in Oct and Dec, although uncertainty around this is higher for BoC than perhaps elsewhere where central bank rate cuts are being priced in.

Unlike the Fed, BoC had not fully normalized rates, so is technically still delivering modest accommodation and therefore may be marginally less compelled to unwind recent normalization. Meanwhile, unlike many regions elsewhere, growth as described above has been solid (albeit likely temporary).

Finally, BoC has not given much signaling, beyond the prior policy meeting that only flagged global risks as introducing uncertainty around medium-term plans to fully normalize interest rates so rather than driven by domestic considerations, the relatively aggressive pricing in of three cuts in the past month seems to be more from the repricing of the Fed curve, pushing down on the BoC curve (refer 2ndchart), with markets seemingly unwilling to price in a Fed funds rate lower than the BoC overnight rate, on the assumptions that BoC will inevitably need to follow the Fed after the Fed has cut 50bps down to BoC’s policy rate level. This assumption will need to be validated by a BoC indicating a willingness to pre-emptively ease – something which may come in the September statement.

Please be positively skewed IVs of 3m tenors are indicating upside risks with OTM bids up to 1.3450 level.

While bullish neutral risk reversal numbers substantiate this bullish stance coupled with 3m skews that are indicating the upside risks. Well, contemplating above driving forces, OTC updates indicate upside risks of USDCAD.

Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure

Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure  RBA Deputy Governor Says November Inflation Slowdown Helpful but Still Above Target

RBA Deputy Governor Says November Inflation Slowdown Helpful but Still Above Target  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data