The event the world has been awaiting, preparing and speculating for is finally approaching - meeting by US Federal Reserve, in which US interest rates will finally rise from their zero bound. After Friday's super job report market is now pricing 81% probability that FED will hike rates in its December meeting, scheduled for December 15th-16th.

In this, FED liftoff series, we will be discussing over the impact, implications and various possibilities of a first rate hike from FED after more than 9 years. Last time FED hiked rates was back in 2006.

In previous articles we discussed why rate hike from FED is still crucial, despite it being well priced in, beginning of a mega unwinding of monetary stimulus and possibilities (decline and deviations) in term premia.

In this piece, we continue in line with term premia but focus on long rates.

Long rates and term premium -

In previous article we introduced the concept of term premium (in a simpler form that it actually is) as the difference in yield to maturity (ytm) between long term rates and short term rates and we discussed, this time around, due to almost seven years of zero bound interest rate led to excessive risk taking along the curve to hunt for yield, it could be different in sense long rates could rise too, post liftoff.

Corporations especially in emerging market economies have borrowed shorter end of the curve, while they invest in the longer end of the investment curve, which might lead to global rise in risk premium pushing long rates higher.

Former FED chair Ben Bernanke, in his blog warned over the rise in long rates

Lessons from history -

Looking at history, we find a mixed result and inconclusive. History shows the possibility of a rise in long term interest rates, when US Federal Reserve hike rates, however it's not a certainty.

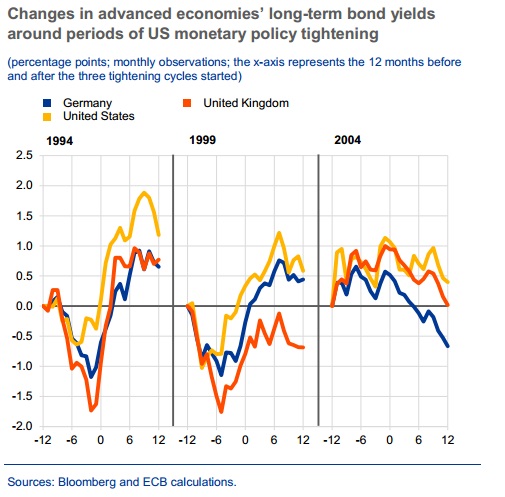

The figure from European Central Bank's (ECB) financial stability review showed, long term yield's reactions to FED hike.

While both in 1994 and 1999 hike cycle, rates have fallen for prior 12 months before rate hike from FED, it reversed course and edged up in next 12 months after hike and ended almost 150 basis points higher from the hike point in 1994 and 70 basis points in 1999 cycle.

But, in 2004 hike cycle, yields actually taken just reverse course of prior two hike cycle and US rates were almost 50 basis points lower in next 12 months.

So, as suggested in the first post, there are considerable uncertainties over how the rate hike might affect longer end of the curve, there are strong reasons to believe as discussed in our term premium article it might go up this time, even if not immediately (3 months) but eventually (12 months).

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal