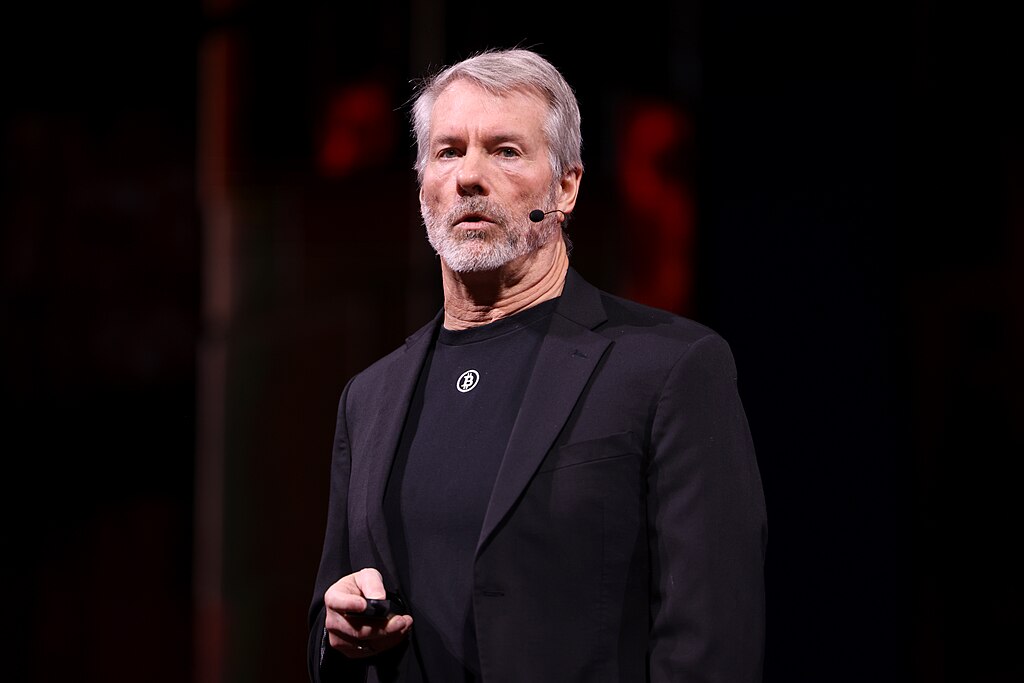

Bitcoin-focused firm Strategy has successfully maintained its position in the Nasdaq 100, extending its stay in the influential index as debates intensify over the sustainability of crypto treasury companies. The decision comes as analysts and index providers increasingly question whether companies centered on buying and holding bitcoin still fit the profile of traditional operating businesses.

Formerly known as MicroStrategy, Strategy began as an enterprise software company before pivoting in 2020 to a bitcoin-heavy balance sheet strategy. Since then, it has become the world’s largest corporate holder of bitcoin, a move that has inspired dozens of similar firms globally. Strategy was added to the Nasdaq 100 in December last year under the technology classification, reflecting its historical roots rather than its current business focus.

However, market observers argue that Strategy’s business model now resembles that of an investment fund more than a technology company. Its stock price has shown extreme sensitivity to bitcoin price fluctuations, amplifying concerns about volatility and long-term viability. These concerns extend beyond Nasdaq, with global index provider MSCI also reviewing whether digital-asset treasury companies should remain in its benchmarks. MSCI is expected to announce a decision in January that could potentially exclude Strategy and comparable firms.

In its latest annual rebalancing, Nasdaq announced the removal of Biogen, CDW Corporation, GlobalFoundries, Lululemon Athletica, On Semiconductor, and Trade Desk from the Nasdaq 100. New additions to the index include Alnylam Pharmaceuticals, Ferrovial, Insmed, Monolithic Power Systems, Seagate Technology, and Western Digital. Despite these changes, Strategy retained its position, underscoring its sizable market capitalization and continued relevance to investors.

The updated Nasdaq 100 composition is scheduled to take effect on December 22. The index tracks the largest non-financial companies listed on the Nasdaq exchange by market value and is widely followed by institutional and retail investors.

As regulatory scrutiny and index methodology reviews continue, Strategy’s future inclusion in major benchmarks may hinge on how index providers define operating companies in an era where digital assets play an increasingly central role.

Big Tech Turns to Debt Markets to Fund AI Infrastructure Boom

Big Tech Turns to Debt Markets to Fund AI Infrastructure Boom  Domino's Pizza UK Reports 15% Drop in Annual Profit Amid Weak Sales and Rising Costs

Domino's Pizza UK Reports 15% Drop in Annual Profit Amid Weak Sales and Rising Costs  Alphabet's GFiber Merges with Astound Broadband to Build Major U.S. Internet Provider

Alphabet's GFiber Merges with Astound Broadband to Build Major U.S. Internet Provider  Thomas Mazloum Named Chair of Disney Experiences as Leadership Shakeup Takes Effect

Thomas Mazloum Named Chair of Disney Experiences as Leadership Shakeup Takes Effect  Lindt Posts Record CHF 5.92 Billion in Sales for 2025, Doubles Share Buyback Program

Lindt Posts Record CHF 5.92 Billion in Sales for 2025, Doubles Share Buyback Program  Bitcoin Teeters Near USD 70,000 as USD 245 Million Liquidation Wave Rocks Crypto Markets

Bitcoin Teeters Near USD 70,000 as USD 245 Million Liquidation Wave Rocks Crypto Markets  BMW Warns of Further Earnings Decline in 2026 Amid Global Trade Pressures

BMW Warns of Further Earnings Decline in 2026 Amid Global Trade Pressures  G7 Oil Blitz Ignites Ethereum Recovery: ETHUSD Reclaims USD 2,000 Threshold

G7 Oil Blitz Ignites Ethereum Recovery: ETHUSD Reclaims USD 2,000 Threshold  Boeing Secures $289 Million Smart Bomb Contract With Israel

Boeing Secures $289 Million Smart Bomb Contract With Israel