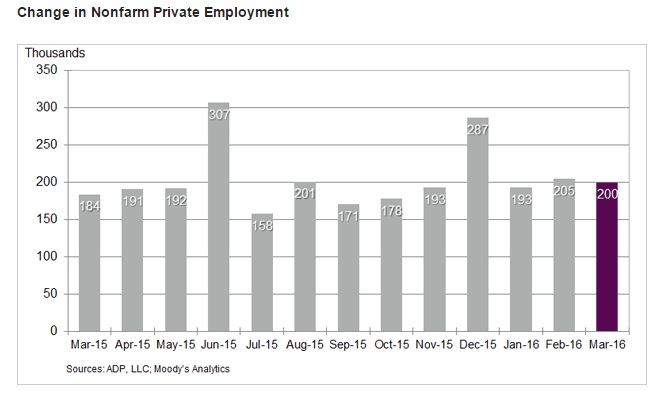

Today ADP employment numbers were released from US for the month of March.

ADP number shows US economy and its labour markets are quite robust, in spite of global economic slowdown.

There are two things to note even in the headline that,

- Job growth beat expectations, numbers indicate resilient labour market, considering market turmoil in early in the year.

- February payroll marginally revised to 205,000 (down from 214,000).

Key highlights

- Non-farm private sector employment grew at 214,000 in March, median expectation was for 194,000.

- Small business sector hiring at 86,000, compared to 76,000 last month.

- Employment in franchise increased to 22,000 compared to last month’s 18,500.

- Mid-sized companies added 75,000 jobs compared to last month’s 62,000 jobs.

- Large sector added just 39,000 compared to last month’s 76,000 jobs.

- Manufacturing sector payroll added 3000 jobs compared to 9000 jobs lost last month.

- 9,000 jobs were added in goods producing sector, compared to last month’s 5,000

- Construction sector added 17,000 on payroll, compared to last month’s 27,000.

- Services sector employment remains robust as payroll added 191,000 people in March. February gains were 208,000.

Dollar is flat after the data, focus now turns to Friday’s NFP report. Dollar index is currently trading at 94.9, down -0.3% so far today.

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals