FxWirePro: South Korean won trades marginally lower after export – import price index data

Aug 14, 2019 01:11 am UTC| Technicals

EUR/KRW is currently trading around 1,352 mark. It made intraday high at 1,352 and low at 1,346 levels. Intraday bias remains slightly bullish till the time pair holds key support at 1,346 mark. A sustained...

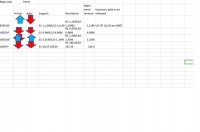

FxWirePro: Major pair levels and bias summary

Aug 13, 2019 12:30 pm UTC| Technicals

Major pair levels and bias...

EURUSD trades in a narrow range, markets eye US CPI

Aug 13, 2019 12:07 pm UTC| Technicals

Major support- 1.11600 EURUSD trades flat for the past 5 trading days between 1.12496 and 1.11619. German ZEW economic sentiment came at -44.1 points well below the forecast of -27.8. The pair hits an intraday high...

Crypto Technicals: Hidden 'Bearish Divergence' to support more weakness in XLM/USD

Aug 13, 2019 11:48 am UTC| Digital Currency Technicals

XLM/USD chart - Trading View Exchange - Kraken Support: 0.0665 (Feb 6 low); Resistance: 0.0808 (21-EMA) Technical Analysis: Bias Bearish Stellar Lumens set to extend weakness. Hidden Bearish Divergence to...

FxWirePro: USD/SEK extends gains, buy on dips

Aug 13, 2019 10:11 am UTC| Technicals

USD/SEK trades 0.05 percent up at 9.5630, having hit a low of 9.5239 last week, its lowest since July 30. Momentum indicators show a bullish trend, with RSI higher at 55.73 levels and Stochs showing bullish...

FxWirePro: Sell USDCHF below 0.9690

Aug 13, 2019 10:03 am UTC| Technicals

Major support- 0.9690 USDCHF is trading in a narrow range between 0.9690 and 0.9800. The escalation of the US-China trade war is putting pressure on this pair at higher levels. The Chinese Yuan is trading weak for...

Crypto Technicals: ETH/USD recovery capped below 21-EMA, scope for weakness till 200-DMA (194.27)

Aug 13, 2019 09:39 am UTC| Digital Currency Technicals

ETH/USD chart - Trading View Exchange - Coinbase Support: 194.27 (200-DMA); Resistance: 216.75 (20-DMA) Technical Analysis: Bias Bearish ETH/USD extends range trade, with session high at 211.28 and low at...

- Market Data