Taiwan central bank likely to enter hiking cycle in 2017, to focus on exchange-rate policy

Dec 22, 2016 10:08 am UTC| Commentary Central Banks Economy

The central bank of the Republic of China (Taiwan) (CBC) is expected to pause the easing cycle in 2017, cautiously assessing the timing of the first interest rate hike. The CBC will primarily focus on the exchange rate...

Philippines central bank considers regulatory framework for bitcoin

Dec 22, 2016 07:11 am UTC| Digital Currency Central Banks

With the increasing volumes of bitcoin remittances, the Philippines central bank is considering introducing digital currency regulations to protect consumers. Bloomberg reports that as the number of overseas Filipinos...

FxWirePro: The Day Ahead- 22nd December, 2016

Dec 22, 2016 06:15 am UTC| Commentary Economy Central Banks

Sizable numbers of economic dockets and events scheduled for today and some with high volatility risks associated. Data released so far: United Kingdom: GFK consumer confidence for December marginally improved to...

PBoC may start another round of policy easing by Q2 2017 – Deutsche Bank

Dec 21, 2016 16:40 pm UTC| Commentary Economy Central Banks

Growth stability in China has alleviated concerns over a hard landing, as quasi fiscal spending pushes up infrastructure investment. Upbeat property market is largely driving stability in Chinas activity data. Chinas GDP...

PBoC infuses cash through X-Repo to snap bond markets out of sharp declines

Dec 21, 2016 15:24 pm UTC| Commentary Central Banks Economy

The Peoples Bank of China (PBoC) had been trying to suppress growing risks in the domestic bond market, which was seen as overheated and displaying characteristics of a bubble by many analysts, citing high leverages in the...

PBoC to tighten supervision of shadow banking businesses; aims to prevent asset bubbles in 2017

Dec 21, 2016 14:33 pm UTC| Commentary Central Banks Economy

The Peoples Bank of China is set to tighten supervision of shadow banking businesses in an effort to prevent asset bubbles in 2017 and to place greater importance on managing financial risk. The PBOC also urged financial...

Dec 21, 2016 13:07 pm UTC| Central Banks Research & Analysis Insights & Views

The Christmas came early yesterday as CBT refrained from raising interest rates, contrary to consensus expectations. CBT explained its inaction by wanting to wait and see the inflationary effects of the liras recent...

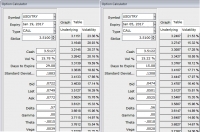

- Market Data