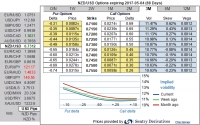

FxWirePro: Deploy USD/TRY diagonal credit call spread as CBRT eases TRY with momentary cushion

Feb 06, 2017 11:45 am UTC| Central Banks Research & Analysis Insights & Views

After a bout of volatility early in the day following publication of inflation data, the lira consolidated its recent gains and ended on a strong note. We view this as a result of improved EM risk sentiment as the USD has...

Feb 06, 2017 11:26 am UTC| Central Banks Insights & Views Research & Analysis

Fundamental glance: Although the Kiwi dollar surged a bit in the recent times but sensing more bearish pressures in the upcoming future especially ahead of the Chinese trade balance data is scheduled to be announced,...

A glimpse over Kiwis exports ahead of RBNZ’s monetary policy

Feb 06, 2017 11:01 am UTC| Central Banks Insights & Views

Kiwi dollar has been gaining traction ahead of following data announcements. NZD IVs have been bolstering above 12.8% owing to this weeks flurry of data streaks, GDT price index on Tuesday, RBNZs monetary policy thats...

Fundamentals to watch out for this week

Feb 06, 2017 10:39 am UTC| Commentary Economy Central Banks

Compared to the previous week, this week is less risk heavy. Not many economic data but there are some events scheduled that might trigger volatility in the market. What to watch for over the coming days: Central...

Feb 06, 2017 10:23 am UTC| Insights & Views Central Banks

The Sweden Central Bank (Riksbank) will announce its next policy decision on February 15th. The Riksbank in December followed the ECB in extending its own asset purchase programme. In addition to the SEK 245 billion...

FxWirePro: Can RBNZ stay pat in OCR? NZD/USD in medium and long term perspectives

Feb 06, 2017 09:57 am UTC| Central Banks Insights & Views

NZD inching higher towards 0.74 against the dollar as the RBNZ has been scheduled for its monetary policy meeting on this Wednesday to decide overnight cash rates followed by press conference. The Ready Reckoner...

German finance minister Wolfgang Schäuble agrees with Trump on Euro but not with ECB

Feb 06, 2017 08:40 am UTC| Commentary Central Banks

Last week, top trade adviser to the Trump administration, Peter Navarro branded Germany as a currency exploiter by suggesting that Germany reaps the most benefits of a devalued euro currency as their own Deutsche Mark...

- Market Data