FxWirePro: Directional optionality and cash trades on interest rate differentials

Mar 24, 2017 07:25 am UTC| Insights & Views Central Banks

We stay short GBPUSD because interest rate based valuations are even more stretched than USDCAD (we expect BoE hawks to be caged by an economy that is finally starting to cool), but once again reduce the directionality to...

FxWirePro: The Day Ahead- 24th March 2017

Mar 24, 2017 05:21 am UTC| Commentary Central Banks

Lots of economic dockets and events scheduled for today but all with low to medium volatility risks associated. Data released so far: Japan: Nikkei flash manufacturing PMI declines to 52.6 in March from 53.3 in...

Malaysia's economy likely to expand at a faster pace in 2017 - Bank Negara

Mar 23, 2017 17:00 pm UTC| Commentary Central Banks

Bank Negara Malaysia (BNM) in its annual report released on Thursday said that it expects Malaysias economy to expand at a faster pace in 2017 on account of recovery in global commodity prices and the continued growth of...

RBNZ expects outlook to be shaped by considerable uncertainty, to stay pat until mid-2018

Mar 23, 2017 16:18 pm UTC| Commentary Central Banks Economy

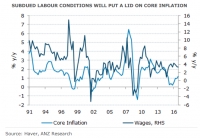

The Reserve Bank of New Zealand (RBNZ) at policy meeting on Thursday, left the Official Cash Rate unchanged at 1.75 percent and reiterated that interest rates will remain low for a considerable time. The policy statement...

FxWirePro: Hedge ZAR in South African inflationary environment via option spreads

Mar 23, 2017 12:36 pm UTC| Central Banks Insights & Views

South African inflation data was due for publication yesterday. Consumer prices in South Africa rose 6.3 pct YoY in February of 2017, following a 6.6 pct gain in January, matching market expectations. It was the lowest...

Mar 23, 2017 11:04 am UTC| Insights & Views Economy Central Banks

Data released by the Ministry of Trade and Industry (MTI) showed Thursday that Singapores headline inflation has accelerated slightly in February, in line with expectations. Singapores headline inflation increased 0.7...

FxWirePro: Macro level hedging radar amid fading interest rates and political tail risks

Mar 23, 2017 11:00 am UTC| Central Banks Insights & Views

The USD index has set a new low for the year having dropped 1.25% on the Feds caution. Not only that, the dollar has now retraced over 60% of the entire Trump rally, which goes a long way to validating a key assumption in...

- Market Data